Pricing and reimbursement of medicinal products in CEE & SEE

Our Life Sciences and Healthcare Law experts have prepared a short practical guide highlighting the main elements of pricing and reimbursement (“P&R“) of medicinal products in the CEE & SEE region.

The P&R guide provides insight into the national reimbursement frameworks, lays down the local rules for pricing of original, generic and biosimilar medicinal products and gives an overview of the key steps in the P&R procedure. The guide also covers specific P&R regimes for products with EMA orphan designation and advanced therapeutic medicinal products, as well the use of managed entry agreements in the specified jurisdictions.

Wolf Theiss’ Healthcare and Life Sciences team numbers more than 30 lawyers across the CEE/SEE, making us one of the most integrated and comprehensive life sciences practices in the region. Our lawyers’ expertise in different legal areas of the industry gives us a strong understanding of the economic, regulatory and market environments across the region.

We would like to thank all members of the Healthcare and Life Sciences team at Wolf Theiss who have contributed their expertise to this guide.

Download the Guide in English

AUSTRIA

1. Overview of the P&R regulatory framework for medicinal products

In Austria, there are three frameworks for the reimbursement of medicinal products depending on whether the medicinal product is: (a) prescribed by a physician and dispensed by a pharmacy to the patient, (b) directly administered by a physician in non-hospital care, or (c) directly administered in hospital care.

- Prescribed by a physician and dispensed by a pharmacy to the patient:

Only the reimbursement of medicinal products prescribed by a physician and subsequently dispensed to the patient by a pharmacy is governed by a standardised procedure.

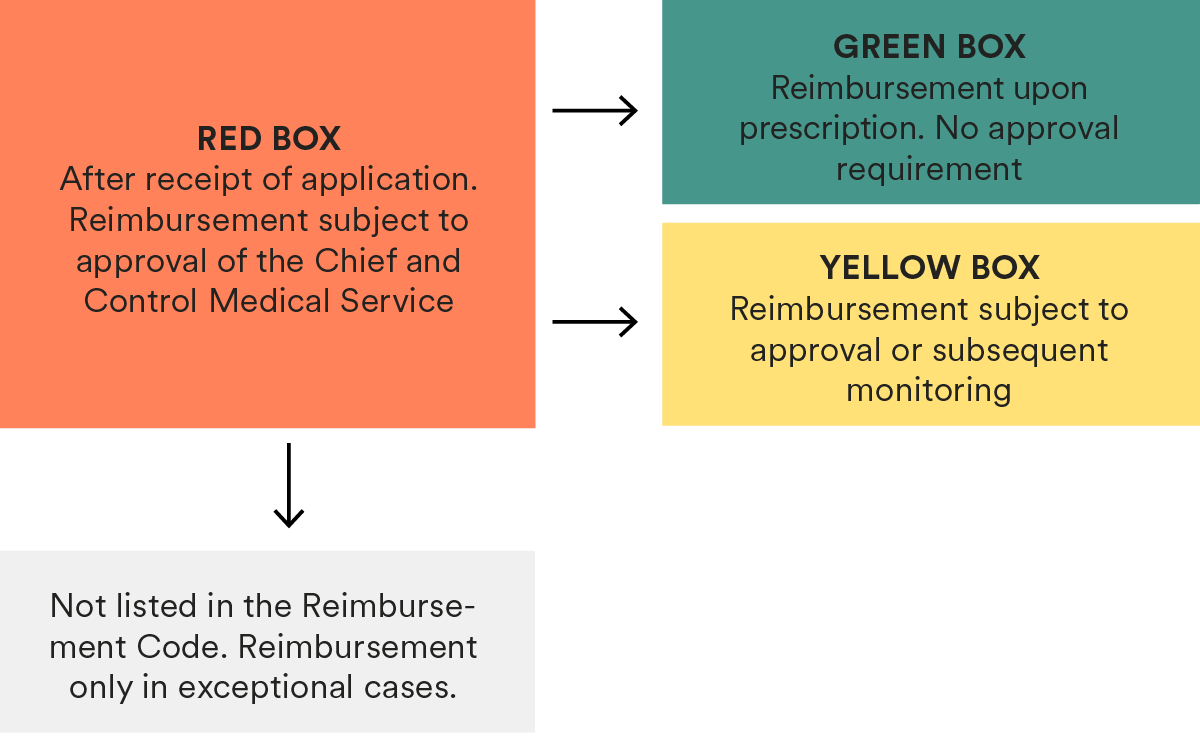

Medicinal products reimbursed under this framework are included in the Reimbursement Code (Erstattungskodex) issued by the Umbrella Organisation of the Social Insurance Carriers (Dachverband der Sozialversicherungsträger – “Dachverband”).Medicinal products which are not included in the Reimbursement Code may only be reimbursed in justified exceptional cases if the treatment is necessary for compelling therapeutic reasons and cannot be carried out with medicinal products listed in the Reimbursement Code (also subject to approval of the Chief and Control Medical Service of the Insurance Carriers).

In the Reimbursement Code, medicinal products are classified into three categories („boxes“): green, yellow and red boxes (see Section 3 below). - Directly administered by a physician in non-hospital care:

In cases where the medicinal product is directly administered by the physician in nonhospital care from his or her own supplies (Ordinationsbedarf) and, thus, supplied by a pharmacy to the physician beforehand, the reimbursement is governed under private law by: (i) overall agreements (Gesamtverträge) between the social insurance carriers or Dachverband and the Physicians’ Chambers for each Austrian province, as well as by (ii) individual agreements (Einzelverträge) between the social insurance carriers or Dachverband and the individual physicians. Consequently, the supply framework differs between the Austrian provinces and between the competent social insurance carriers (for example, there are different social insurance carriers for employees and for self-employed persons).Usually, physicians can either buy their own supplies at the pharmacies and then apply for reimbursement at the social insurance carriers, or they can order their supplies through an online shop or other centralised platform (depending on the Austrian province) directly at the social insurance carrier which then examines whether the products will be reimbursed (primarily based on economic objectives) and forwards the order to a pharmacy.In addition, some insurance carriers may hold a stockpile of certain products which can be used by physicians in non-hospital care.

- Directly administered in hospital care:

In hospital care, medicinal products are usually procured by hospital pharmacies either directly from a market authorisation holder (MAH) or from wholesalers and then administered to the patient within the hospital.

Hospital operators are obligated to set up a Medicines Commission (Arzneimittelkommission) responsible for the selection and use of medicinal products. If added to the hospital’s list of medicinal products, procurement of those products is taken care of by the hospital pharmacy.

Generally, a patient covered by public social insurance does not have to pay for treatment or medicinal products used in public hospitals or private hospitals, which are contractual partners of his or her social insurance carrier. The costs are borne by the hospital operators and reimbursed to them under private-law agreements between hospital operators / the competent Professional Association (Fachverband / Fachgruppe) for hospitals at the Chamber of Commerce (Wirtschaftskammer) and the social insurance carriers / Dachverband.

2. Pricing rules

Different pricing rules apply to each of the three reimbursement frameworks (see Section 1 above):

- Prescribed by a physician and dispensed by a pharmacy to the patient:

For products reimbursed under the Reimbursement Code, the price must not exceed the average price in all EU Member States where the products are authorised and placed on the market which is regularly determined by the Price Commission (Preiskommission) at the Federal Health Ministry.If no substantial innovation or additional benefit can be found, the medicinal product will only be added to the green box of the Reimbursement Code (i.e., the medicinal product can be prescribed without approval of the Chief and Control Medical Service of the Insurance Carriers) if there is a relevant price difference with comparable medicinal products.

Generics and biosimilars

In order for a generic or biosimilar product to be included in the Reimbursement Code by Dachverband, the price must be below the price of the original product, as follows:First generic / biosimilar: 28.6% / 11.4% below the price of the original medicinal productSecond generic / biosimilar: 18% / 15% below the price of the 1st generic / biosimilarThird generic / biosimilar: 15% / 10% below the price of the 2nd generic / biosimilar

Furthermore, following entry of the generic / biosimilar product, the original medicinal product may only remain in the Reimbursement Code if an MAH agrees to a price reduction of 30%.

In certain cases, Dachverband may apply deviating rules in order to support the availability of a generic or biosimilar.Prices outside of the reimbursement regime

If medicinal products are sold outside the Reimbursement Code regime, the price will generally be determined by an MAH or wholesaler selling its products to pharmacies. Pharmacies may add a regulated margin to the wholesale price. - Directly administered by a physician in non-hospital care:

Where medicinal products are directly administered by the physician in non-hospital care from his or her own supplies, the price will generally be determined by the manufacturer or wholesaler selling its products to the pharmacies. Pharmacies may add a regulated margin to the wholesale price. The amount reimbursed to the physicians depends on the applicable agreement (see Section 1.b above). - Directly administered in hospital care:

With regard to inpatient care, there are no specific laws regarding pricing rules. The price will be agreed upon between the hospital (pharmacy) operator and the manufacturer / wholesaler. Pricing negotiations are usually confidential. The amount reimbursed by social insurance carriers to the hospital operators is determined by agreements between the hospital operator and the social insurance carriers (see Section 1.c above).

3. Key steps in the P&R procedure

The procedure to obtain reimbursement for a medicinal product varies between the three reimbursement frameworks (see Section 1 above):

- Prescribed by a physician and dispensed by a pharmacy to the patient:

With respect to the reimbursement of medicinal products that are prescribed by a physician and dispensed by a pharmacy, only medicinal products included in the Reimbursement Code, per decision of Dachverband, must be reimbursed by the public social insurance carriers on a regular basis. Medicinal products which are not included may only be reimbursed in justified exceptional cases if the treatment is necessary for compelling therapeutic reasons and cannot be carried out with medicinal products listed in the Reimbursement Code (also subject to approval of the Chief and Control Medical Service of the Insurance Carriers).In the Reimbursement Code, medicinal products are classified in one of three categories („boxes“) (green, yellow and red). This classification basically determines the prioritisation in the selection of the medicinal product in the course of the reimbursable prescription.

The relevant procedure can be summarized as follows:

– For the inclusion of a medicinal product in the Reimbursement Code, an application must be submitted to Dachverband;

– After receipt of an application for inclusion in the yellow or green box of the Reimbursement Code, Dachverband examines whether the application is submitted formally correct and at least contains the marketing authorisation number, price, a confirmation of the ability to supply the medicinal product and confirmation of the duration of the patent term. If affirmative, the medicinal product will temporarily be included in the red box (i.e., reimbursement is subject to approval of the Chief and Control Medical Service of the Insurance Carriers);

– Dachverband must decide within 90 days (if a decision is also made on the price, within 180 days) following receipt of the application whether the medicinal product will be included in the yellow or green boxes of the Reimbursement Code. In case of a negative decision, the medicinal product is also removed from the red box;

– As a next step, following consultation with the Medicines Evaluation Committee (Heilmittel-Evaluierungs-Kommission), Dachverband examines whether there are any reasons that would exclude the medicinal product from reimbursement (e.g., not suitable for use outside of hospital care, mandatory package size requirements are not met, etc.). Dachverband must inform the applicant of any doubts regarding those requirements and request a written statement;

– If none of the reasons that would exclude reimbursement apply, Dachverband decides on the inclusion of the medicinal product based on its price, additional therapeutic benefit for the patient and / or therapeutic innovation compared to other medicinal products already included in the Reimbursement Code;

– The decision by Dachverband can be challenged before the Federal Administrative Court (Bundesverwaltungsgericht).

- Directly administered by a physician in non-hospital care:

There is no centralised P&R process for medicinal products that are directly administered by the physician in non-hospital care from his or her own supplies. From the point of view of MAH and wholesalers, the product can get reimbursed by: (i) agreeing with the social insurance carriers to reimburse or stockpile a specific medicinal product, and / or (ii) placing marketing activities which might encourage physicians to buy the medicinal product. - Directly administered in hospital care:

There is no centralised P&R process for medicinal products that are administered in hospital care. From the point of view of MAH and wholesalers, the product can be reimbursed by encouraging hospital operators to buy the medicinal product through their hospital pharmacies by including them in the list maintained by the respective Medicines Commission. It can also be helpful to encourage the social insurance carriers to reimburse the medicinal product.

4. P&R for specific categories of products

There is no specific legal framework for the reimbursement of orphan drugs. However, a medicinal product which cannot be listed in the green box of the Reimbursement Code (see below) due to health-economic reasons, may still be included in the yellow box if it shows substantial additional therapeutic value for patients.

Medicinal products which are not included in the Reimbursement Code may be reimbursed in justified exceptional cases if the treatment is necessary for compelling therapeutic reasons and cannot be carried out with medicinal products listed in the Reimbursement Code (also subject to approval from the Chief and Control Medical Service of the Insurance Carriers).

5. Managed Entry Agreement in the P&R process

Managed Entry Agreements („MEA”) are not mandatory in Austria. MEAs may include cost / risk sharing models that will help to manage the uncertainty around the financial impact or performance of a medicinal product. They are usually confidential and concluded between MAH and the social insurance carriers or operators of hospital pharmacies. The use of MEAs by social insurance carriers and publicly funded health institutions has been criticized in Austria due to the lack of transparency.

Related experts

BULGARIA

1. Overview of the P&R regulatory framework for medicinal products

From the perspective of pricing and reimbursement (“P&R”), Bulgarian law differentiates between: (i) medicinal products eligible for reimbursement; and (ii) medicinal products that are not eligible for reimbursement (which are subject to different pricing procedures).

Medicinal products eligible for reimbursement

In order to receive (full or partial) reimbursement from public funds, a medicinal product (and its respective INN) must go through a process of assessment and admittance for reimbursement by the National Council of Reimbursement2 (“Council”), and ultimately, be added to the National Reimbursement List. The latter is comprised of 4 parts, which regulate the different reimbursement regimes (depending on whether the product is intended for home treatment or hospital use, the reimbursing institution/budget covering the costs, etc.):

- Part one to the reimbursement List refers to medicinal products designated for athome treatment of specifically designated diseases. Medicinal products from this Part are reimbursed by the National Health Insurance Fund (NHIF) to patients upon purchasing the medicines;

- Part two to the Reimbursement List covers medicinal products for hospital treatment which are reimbursed by the NHIF as part of the health care services provided by hospitals. The scope of the medicinal products in this part and related treatments is subject to negotiation and the conclusion of a National Framework Agreement between the NHIF and the Bulgarian Medical Association, along with subsequent bilateral agreements with healthcare providers;

- Part three to the Reimbursement List includes medicinal products for hospital use intended for treatment/prevention of specific diseases of public importance (e.g. AIDS, infectious diseases, vaccines for compulsory immunisations and reimmunisations, etc.), reimbursed by the budget of the Ministry of Health;

- Part four to the Reimbursement List provides the maximum registered price of the medicinal products included in Parts one to three of the Reimbursement List.

The criteria for inclusion in the Reimbursement List include: (i) medical and therapeutic efficacy; (ii) safety and pharmacoeconomic analysis, and (iii) pharmacoeconomic criteria (incl. cost effectiveness, budget impact, etc.). For medicinal products with a new INN, a health technology assessment (HTA) is also required.

The above criteria are assessed based on an officially approved matrix. Medicinal products which achieve 60 or more points as per the above criteria are eligible for inclusion in the Reimbursement List.

Medicinal products not eligible for reimbursement

Medicinal products outside the Reimbursement List are generally not subject to reimbursement from public funds.

Such medicinal products may be reimbursed from the state budget: (i) if they are used for prevention or treatment in the event of epidemics, pandemics, as well as in the event of suspected or confirmed spread of chemical or biological agents or nuclear radiation; and (ii) in ad-hoc cases (e.g. in the scope of emergency assistance).

2. Pricing rules

Regardless of whether a medicinal product is included in the Reimbursement List, it shall have a registered (maximum) price in order to be sold on the Bulgarian market.

The registered (maximum) price for all medicinal products (both in and outside of the Reimbursement List) is determined as the sum of: (i) the lowest manufacturer’s price for the same medicinal product in a group of reference states; (ii) the wholesaler surcharge on the manufacturer’s price (currently 4-7%); (iii) the retailer’s surcharge on the manufacturer’s price (currently 16-20%); (iv) value added tax (currently 20%).

Medicinal products that are eligible for inclusion in the Reimbursement List are subject to a joint P&R procedure, whereas medicinal products outside the Reimbursement List undergo a stand-alone pricing process. Different requirements and rules apply for each process.

Generics and biosimilars

The price of the first generic product and first biosimilar product on the Reimbursement List cannot exceed 70% and 80% of the original product respectively.

3. Key steps in the P&R procedure

P&R procedure for medicinal products in the Reimbursement List

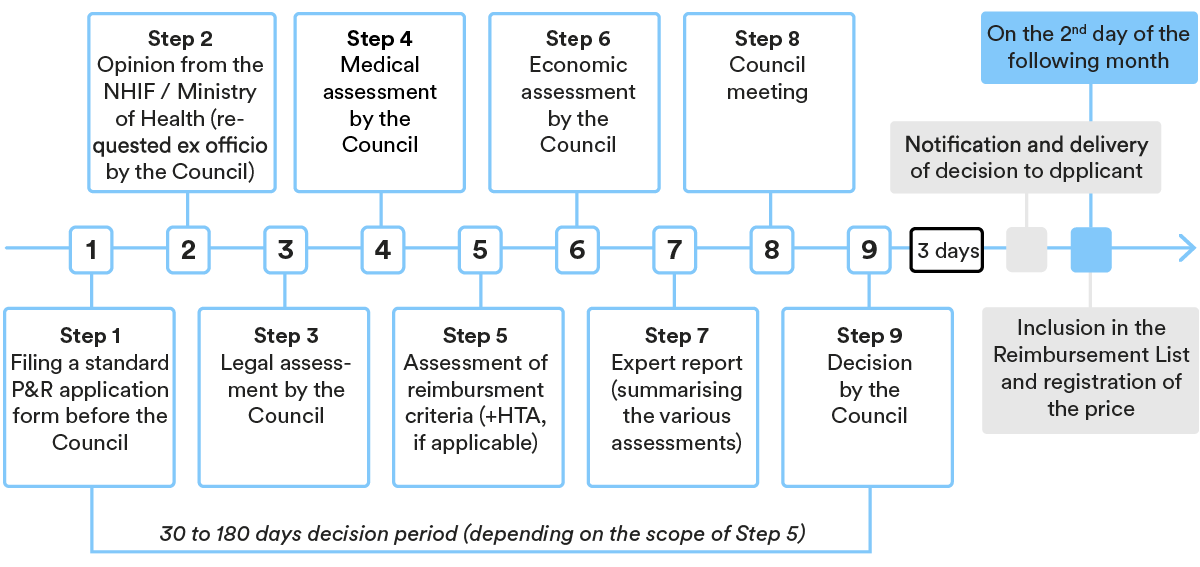

In general, the procedure entails the following main steps (deviations are possible depending on the case):

Pricing process for medicinal products outside the Reimbursement List

In general, the procedure entails the following main steps (deviations are possible depending on the case):

4. P&R for specific categories of products

Orphan medicinal products and Advanced Therapy Medicinal Products (ATMPs) are subject to the same P&R process as outlined in the points above.

Where an HTA is applicable as part of the P&R process, additional assessment criteria shall apply for orphan medicinal products, including additional evidence of the benefits of the medicinal product (for a period of up to 1 year); moral and ethical considerations and so on. An economic evaluation and the overall budgetary impact shall also be presented for orphan drugs that have a high social benefit, are not cost-effective and whose use is indicated for serious conditions that have no effective alternative therapy.

5. Managed Entry Agreement in the P&R process

Bulgarian law applies an annual mandatory centralised rebate negotiation procedure between the NHIF and MAHs for medicinal products subject to reimbursement. The agreed rebates are formalised under a Managed Entry Agreement (“MEA”), which are mandatory in the P&R process for:

- medicinal products with a new international non-proprietary name (INN);

- medicinal products with pending applications for inclusion in the Reimbursement List;

- medicinal products included in Parts one and two of the Reimbursement List, for which the reimbursement amount by the NHIF is calculated by grouping (which does not include medicinal products of other MAHs).

The minimum rebate amounts are statutorily set (10%-20% of the reimbursed price) and differ depending on the category to which the medicinal product pertains.

Negotiation of further rebates is possible based on bilateral arrangements.

Related experts

CROATIA

1. Overview of the P&R regulatory framework for medicinal products

Medicinal products are reimbursed by the Croatian Health Insurance Fund (Croatian: Hrvatski zavod za zdravstveno osiguranje; “HZZO”) if placed on the relevant HZZO’s reimbursement list (“Reimbursement List”) for the specific indication.

This is possible only after the highest permissible wholesale price has been determined by the Croatian Agency for Medicinal Products and Medical Devices (Croatian: Hrvatska agencija za lijekove i medicinske proizvode; “HALMED”) at the request of the marketing authorisation holder (“MAH”). Only prescription medicinal products can be placed on the Reimbursement List.

Certain Croatian private insurance companies offer coverage of patient participation in the price of medicinal products which are not fully reimbursed by HZZO, as a part of their supplemental medical insurance policy.

2. Pricing rules

The pricing procedure is comprised of two steps: determination of the highest permissible wholesale price by HALMED, and determination of price paid by HZZO for medicinal products placed on the Reimbursement List.

Determination of highest permissible wholesale price by HALMED

HALMED calculates the highest permissible wholesale price primarily as 100% of the average of comparable medicinal product prices in Italy, Slovenia and the Czech Republic. If it is not possible to assess the price based on these countries, they are replaced by other relevant countries according to the statutory procedure, or by MAH’s substantiated proposal of the price.

The highest permissible wholesale price is re-calculated by HALMED on a yearly basis in accordance with statutory rules. Under certain conditions it is possible for the MAH to request that HALMED increase the highest permissible wholesale price.

Determination of price paid by HZZO for medicinal products placed on the Reimbursement List

In general, HZZO determines the price which will be paid (reimbursed) by HZZO based on the: (i) highest permissible wholesale price determined by HALMED, (ii) price of medicinal products already placed on the Reimbursement List, (iii) therapeutic group and subgroup, and (iv) criteria for placement of medicinal products on the Reimbursement List.

The Reimbursement List price depends on the novelty and the therapeutic value of the active ingredient:

- if a medicinal product contains a completely new active ingredient which materially increases the possibility of recovery – the price may not be higher than the highest permissible wholesale price determined by HALMED;

- if a medicinal product contains a completely new active ingredient and there are medicinal products already included in the HZZO’s Reimbursement List with the same or similar pharmacological and therapeutic indications (level 4 of the ATC classification of medicinal products) and the same indication is proposed – the price may not be higher than 95% of the price of the comparable medicinal product on the Reimbursement List;

- if a medicinal product contains a completely new active ingredient, and there are medicinal products already included in the HZZO’s Reimbursement List with the same or similar pharmacological and therapeutic characteristics (level 4 of the ATK classification of medicinal products) – the price may be determined as 100% of the price of the comparable medicinal product if MAH proves that the medicinal product has added value;

- the price of the first generic product may not exceed 70% of the price of the medicinal product with the same active ingredient (same common name), which is already placed on the Reimbursement List;

- the price of the first biosimilar product may not exceed 80% of the price of the medicinal product with the same active ingredient (same common name), which is already placed on the Reimbursement List;

- in case of any subsequent (third, etc.) generic medicinal product or biosimilar product – the price may not exceed 95% of the Reimbursement List price determined for the second medicinal product.

The Reimbursement List price is re-calculated by HZZO in accordance with statutory rules.

3. Key steps in the P&R procedure

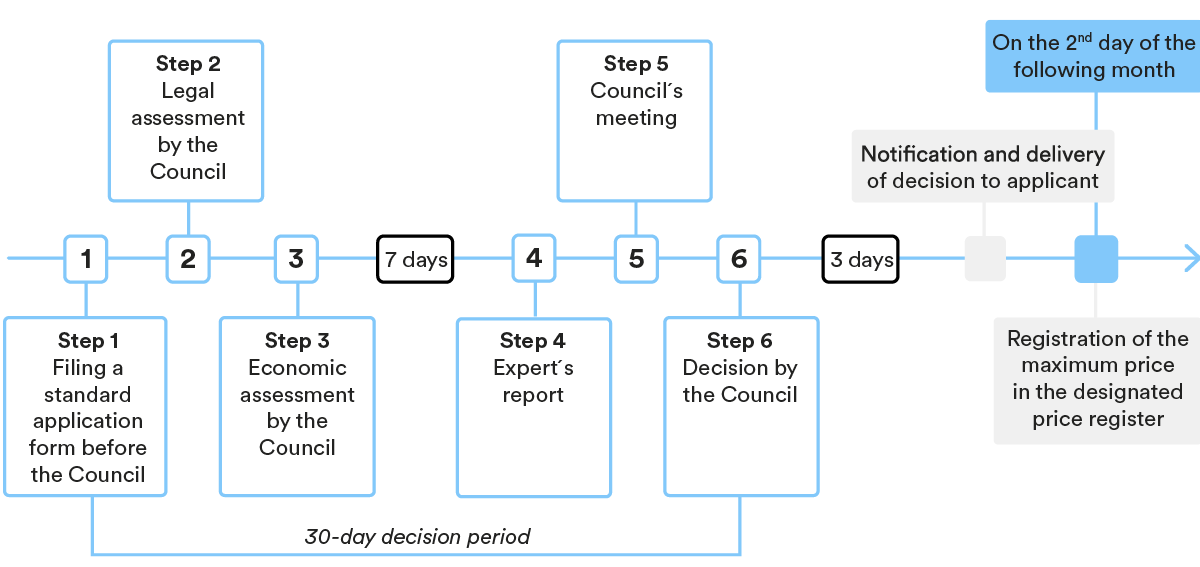

Under Croatian law, the pricing and reimbursement procedure for prescription medicinal products includes two major steps: (i) determination of a highest permissible wholesale price by HALMED; and (ii) placement of a medicinal product on the Reimbursement List and determination of the reimbursement price by HZZO.

Determination of the highest permissible wholesale price for the medicinal product

- Submission of the request

As a first step, MAH needs to submit a request to HALMED for determination of the highest permissible wholesale price for the specific product, together with the statutory prescribed documentation.

- Decision-making procedure

HALMED issues a decision on the determination of the highest permissible wholesale price within 30 days of receipt of a duly completed application. In case additional/supplemental documents are required, the deadline for issuing the decision is prolonged by 15 days.

For pricing rules please see Section 2. above.

Placement of medicinal product on the HZZO’s Reimbursement List

- Submission of the request

After the highest permissible wholesale price has been determined by HALMED, the MAH or its authorised representative needs to submit a request for placement of the medicinal product on HZZO’s Reimbursement List (for new active ingredients or new indications) or a request for supplementation of the Reimbursement List (for generic medicinal products and biosimilars), together with the statutory prescribed documentation.

Under certain conditions, it is possible to simultaneously also submit a request to HZZO that the medicinal product be placed on the list of especially expensive medicinal products, in which case HZZO and MAH must conclude a managed entry agreement (“MAE”; see Section 5 below for details).

- Decision-making procedure

HZZO’s Medicinal Products Committee and HZZO’s Governing Council are the main HZZO bodies deciding on the placement of medicinal products on the Reimbursement List.

In addition, HZZO’s Medicinal Products Committee may request additional opinions from the Croatian Physicians Association (Croatian: Hrvatski liječnički zbor), Ministry of Health (Croatian: Ministarstvo zdravstva), HALMED or other experts.

Criteria for placement of medicinal products on the Reimbursement List include:

- importance of the medicinal product from a public health standpoint;

- therapeutic value of the medicinal product in relation to the proposed indication;

- relative therapeutic value of the medicinal product

- evaluation of ethical aspects;

- optimal dosage of the medicinal product needed for treatment based on diagnosis and stage of the disease;

- price of the medicinal product / pharmacoeconomic analysis;

- marketing authorization; and

- number of EU member states in which the medicinal product has been placed on the market and number of EU member states in which the medicinal product is funded by national health insurance funds.

For pricing rules please see Section 2 above.

4. P&R for specific categories of products

Orphan medicinal products are subject to the same P&R process as outlined in the points above. In general, the same also applies for Advanced Therapy Medicinal Products (ATMP).

When submitting a request for placing such products on the Reimbursement list, MAH may also submit a proposal for their inclusion on the HZZO’s list of especially expensive medicinal products, together with the statutory prescribed documentation and information. As part of the P&R process, HZZO will also take into account/assess ethical aspects if there are no other therapeutic options and if the product significantly improves the long-term course of the disease or the quality of life of patients.

5. Managed Entry Agreement in the P&R process

MEA is a set of instruments to facilitate access to new medicines. It is used in Croatia, including the financial and the performance-based agreement, the former being used more often.

MEAs are mandatory if the medicinal product is to be placed on the list of especially expensive medicinal products. In such a case, HZZO is obligated to take into account the total consumption of all medicinal products from the Reimbursement List within the therapeutic indication. During the last few years, a new model of concluding MEAs for especially expensive medicinal products has been introduced, which requires MAH to participate to a greater extent than before in the cost of treatments that are ultimately ineffective. HZZO enters into MEAs (financial MEAs) where MAH commits to an expenditure cap with a payback obligation if the cap is exceeded or, for example, MAH repays a certain percentage from the total consumption, which ranges from 10% – 40%.

HZZO and MAH may also optionally enter into an MEA at the moment of placement of the medicinal product on HZZO’s Reimbursement List or afterwards (as long as the medicinal product is included on the Reimbursement List) for the purpose of: (a) defining a price that is different (i.e. lower) than the list price, which will be paid (reimbursed) by HZZO, or (b) defining the financing relationship for that medicinal product.

CZECH REPUBLIC

1. Overview of the P&R regulatory framework for medicinal products

In terms of pricing and reimbursement (P&R), Czech law distinguishes between: (i) prescription medicinal products (Rx) which are generally eligible for reimbursement; and (ii) over-the-counter (OTC) medicinal products that are not elligible for reimbursement.

Rx products are covered by public health insurance if:

- the product (and its relevant indication) is included in the Reimbursement List; and

- the maximum price has been determined for said product.

In the Czech Republic, the majority of reimbursed medicinal products are price-regulated. To be included in the Reimbursement List, the State Institute for Drug Control (SUKL) must set the maximum price and reimbursement in an administrative procedure that is based on an individual application by the marketing authorisation holder (MAH).

The main reimbursement criteria include:

- therapeutic efficacy and safety,

- cost-effectiveness,

- budget impact.

Reimbursement is based on the lowest price per average daily dose (ADD) across the European Union. For reimbursement purposes, products can be clustered into reference groups. Within each group, reimbursement is set at the lowest price of any substance within the group.

Reimbursement of medicinal products or their indications that are not included in the Reimbursement List, including off-label uses and uses of non-authorised products, may be approved by the relevant health insurance companies on an individual basis.

For medicinal products provided to patients as part of treatment in hospitals, reimbursement is determined by an individual contractual agreement between the hospital and the health insurer. The financial costs incurred for medicines are reimbursed from the so-called drug lump sum or based on a specific contract.

2. Pricing rules

In the Czech Republic, statutory prices apply to all reimbursable medicinal products. The official maximum price is equal to the highest ex-factory price, which cannot be exceeded. A digressive margin (common for distributors and pharmacies) and value-added tax (10%) are then added to the manufacturer’s selling price to determine the public price.

External Reference Pricing

The ex-factory price of a given medicinal product is determined as the average of the three lowest prices based on a reference basket. The countries in the reference basket include all EU countries except Austria, Bulgaria, Cyprus, Czech Republic, Estonia, Greece, Luxembourg, Malta and Romania.

If there is a more capable and cost-effective therapy that costs less than the reimbursement determined on the basis of reference prices, the SUKL determines the basic reimbursement on the basis of the daily price of the nearest therapeutically comparable therapy available in the Czech Republic, or in the reference basket countries.

In addition, the law allows for the basic reimbursement to be set according to the manufacturer’s proposed price, specified in the maximum price agreement or reimbursement agreement, or according to the price specified in the agreement concluded with all health insurance companies in public interest.

If a medicinal product (with the exception of highly innovative products) is not on the market in at least three reference basket countries, the agreed price of the medicinal product can be used in the assessment.

Generics and biosimilars

SUKL reduces the maximum price and reimbursement depending on the type of a first similar product by:

- 30% – entry of 1st biosimilar, when there is one reimbursed original biologic product in the reference group;

- 40% – entry of 1st generic, when there is one reimbursed original product in the reference group;

- 15% – entry of 1st original, when there is one reimbursed original product in the reference group.

Price and reimbursement review

A system of periodic, in-depth and abbreviated reviews of maximum prices and reimbursements is in place to assess whether the prices and reimbursements that are set are in line with the requirements of the law and to achieve savings in public health insurance funds.

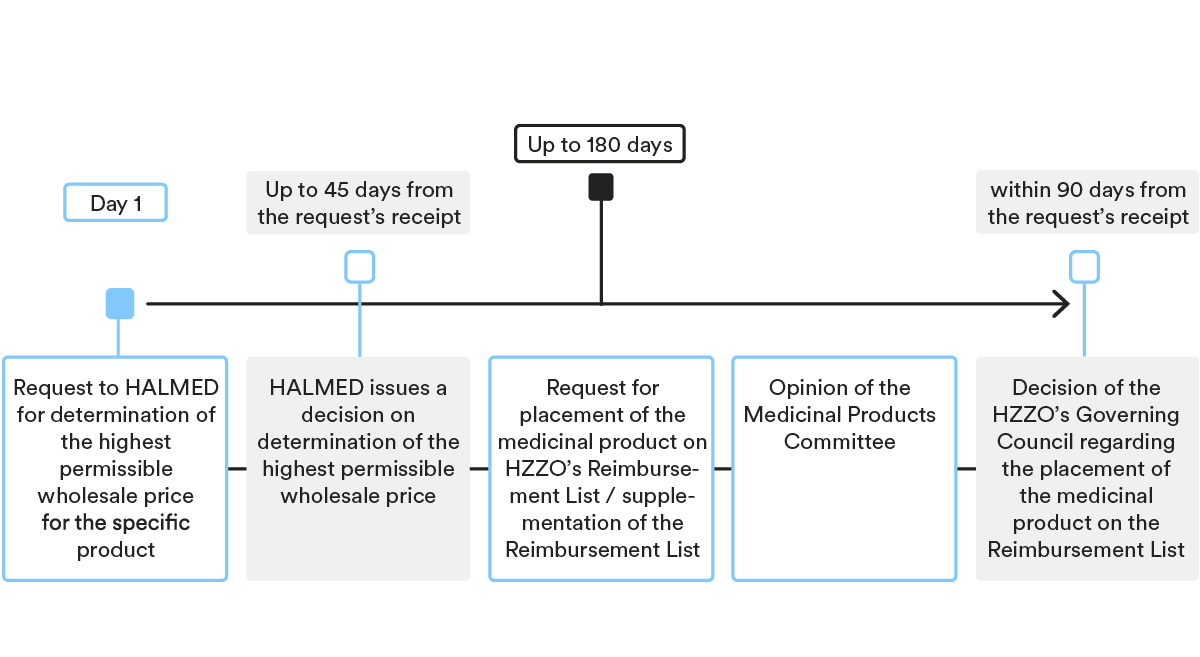

3. Key steps in the P&R procedure

The structure of the reimbursement procedure is set out in the chart below.

The SUKL must decide on the price and reimbursement within 165 days from the start of the procedure (for joint procedures) or within 75 days for procedures initiated only for the purpose of setting the maximum market price or reimbursement conditions. Procedures may be extended by a further 60 days.

Although the law requires that the entire P&R process is completed within 165 days, this timeframe is often exceeded. In practice, the duration of the P&R procedure tends to take around 8 to 12 months, or 6 months for generic/biosimilar medicinal products. In the case of innovative and premium products, the evaluation process takes often up to two years. The P&R set-up is then reviewed every three to five years.

4. P&R for specific categories of products

Orphan products

The law sets out a special procedure for assessing and approving the reimbursement of orphan medicinal products (OMP) from public health insurance, which requires the involvement of scientific societies and representatives of patient organisations in the whole process.

The decision-making process for reimbursement of OMP has two phases, the first is led by SUKL and the second by the Ministry of Health (MoH). The task of the MoH is to review the assessment report and issue a binding opinion, which SUKL is obliged to follow. For this purpose, a special advisory body is established at the MoH.

New soft criteria have been introduced to assess the cost-effectiveness of OMPs, such as the social relevance of their potential therapeutic effect and the impact of the treatment on the health and social insurance system. Cost-effectiveness analyses should still be provided, but without taking into account their results in the form of an incremental cost-effectiveness ratio (ICER).

Highly innovative medicinal products

Reimbursement of highly innovative medicinal products (HIMPs) – many of which are orphan products – may be granted for a limited period of 3 years, followed by a further extension of 2 years, for a maximum period of 5 years in total. There is no need to demonstrate costeffectiveness in the case of an application for temporary reimbursement.

After the expiry of the temporary reimbursement, patients who have been treated with HIMP have the right to be treated at MAH expense until they switch to a comparable treatment covered by health insurance.

For both HIMPs and OMPs, the cost to health insurance funds for their reimbursement during the temporary reimbursement period must not exceed the amount indicated in the budget impact analysis. Each health insurer enters into a contract with the MAH for a payback in the event that the budget impact analysis costs are exceeded.

Advanced therapy medicinal products

The reimbursement of mass-produced advanced therapy medicinal products (ATMPs) is now determined in a standard administrative procedure, in other words, no longer through a specific general measure issued by the SUKL.

5. Managed Entry Agreement in the P&R process

Negotiated maximum prices and reimbursements

One of the instruments for P&R is the negotiated maximum prices of medicinal products and reimbursement agreements concluded between MAHs and health insurance companies. A medicinal product for which such an agreement has been concluded is always considered to be available on the market in the Czech Republic.

Risk-sharing agreements

Contractual arrangements for risk sharing and setting limits on treatment costs or the impact on the budget between health insurers and pharmaceutical companies have become common in the last few years (this is the rule in the case of HIMPs and OMPs). Such cost/ risk sharing schemes often include discounts or budget limits.

A more sophisticated instrument is outcome-based risk sharing, where reimbursement is

provided only if the treatment meets defined expectations. However, these models are

challenging because they require complex patient data and clearly defined and measurable

outcomes, which means they have only been used in a limited number of cases to date.

Related experts

HUNGARY

1. Overview of the P&R regulatory framework for medicinal products

In terms of pricing and reimbursement, Hungarian legislation distinguishes between reimbursable and non-reimbursable medicinal products, both being subject to different pricing rules.

Two types of products are eligible for reimbursement (i.e. inclusion in social security funding) (“Reimbursement Scheme”) in Hungary: (i) medicinal products and (ii) formulae for special dietary needs. This review focuses on the process regarding medicinal products only.

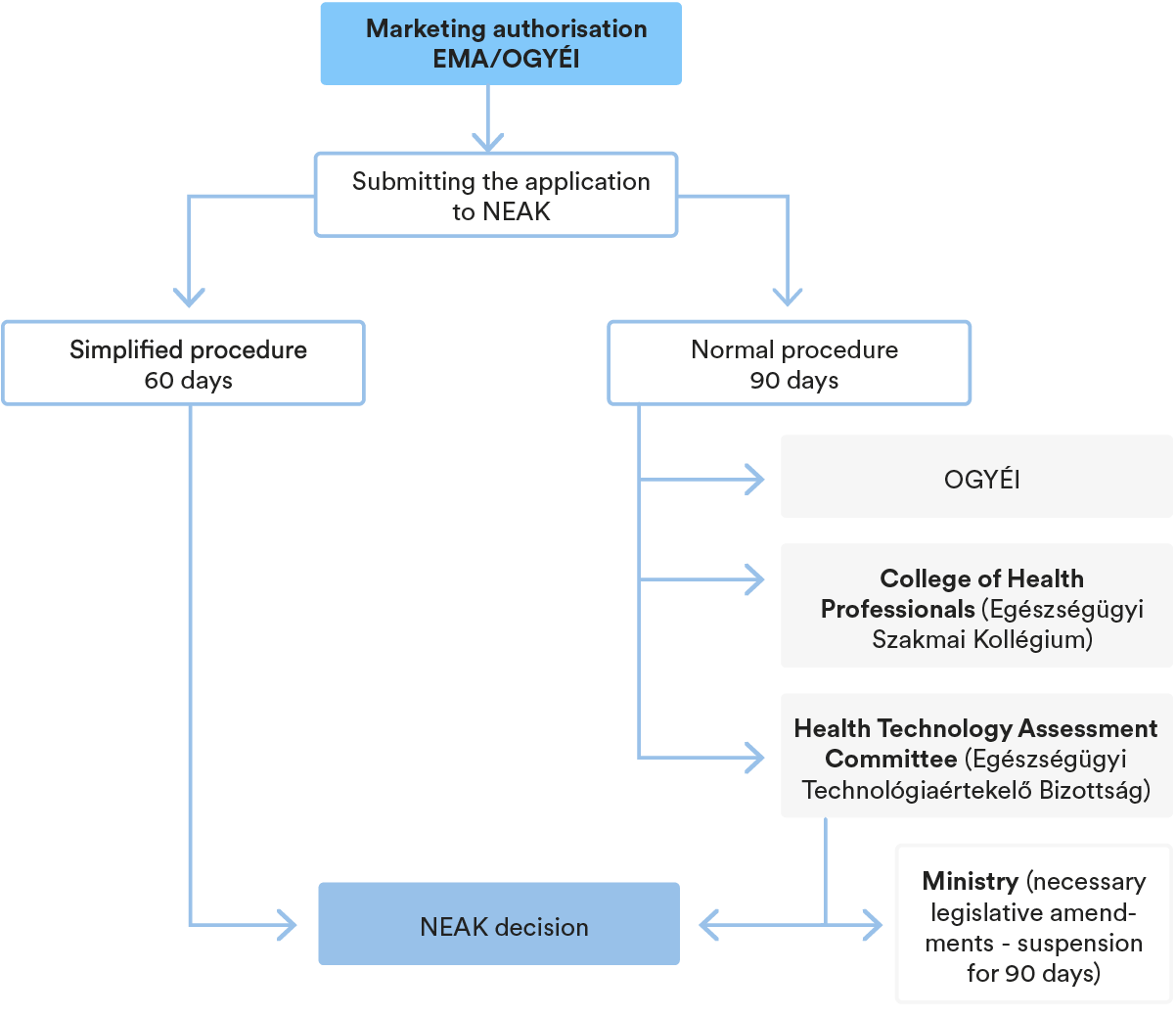

In order to be included in the reimbursement scheme, the marketing authorisation holder of medicinal products (“MAH”) has to submit a request to the National Health Insurance Fund of Hungary (“NEAK”) to have the relevant medicinal product included (“Inclusion Request”) in the social security funding system (“SSFS”). The NEAK’s proceeding may be initiated by means of the Inclusion Request, whereas the NEAK may also proceed based on cases prescribed by law, without any separate request, ex officio.

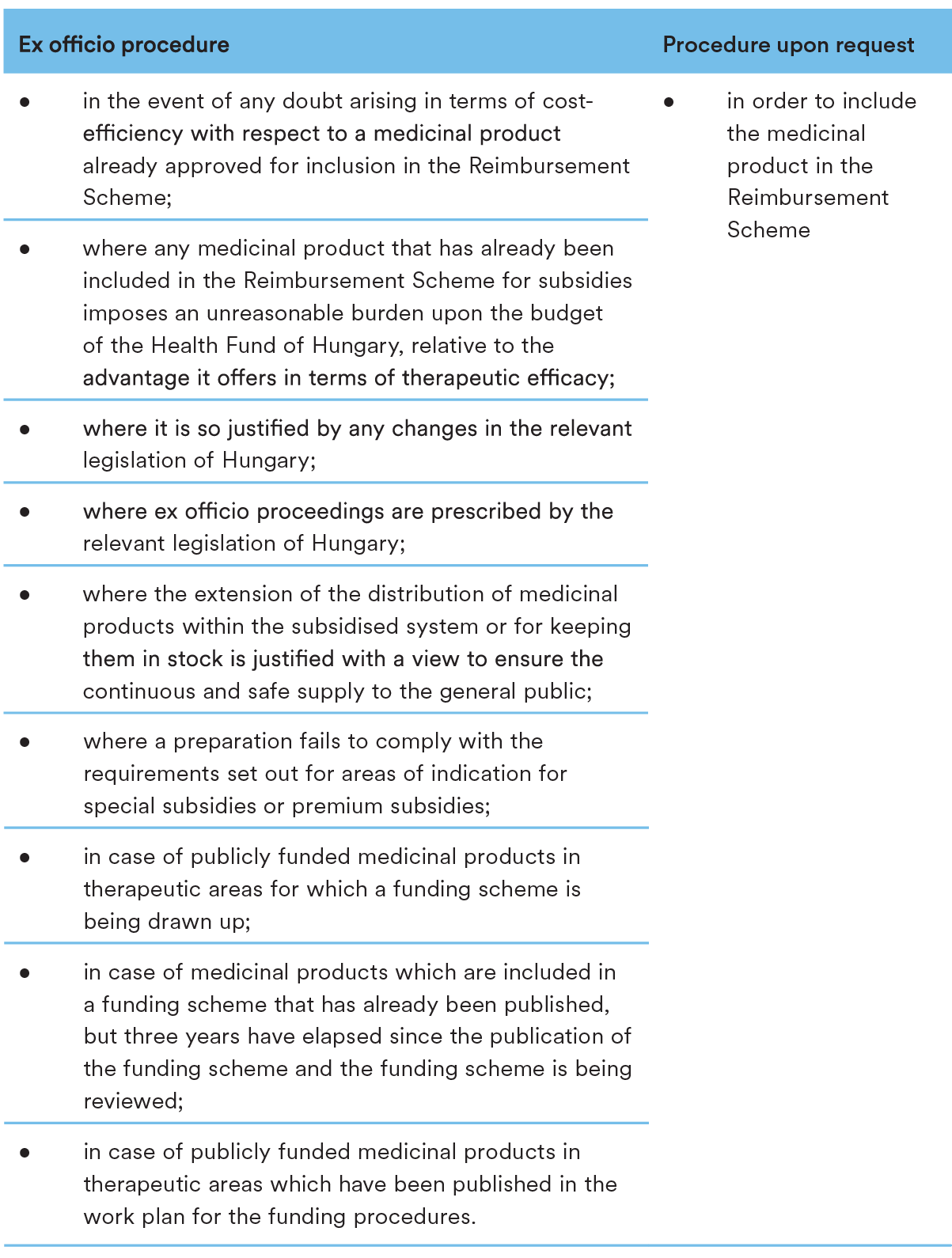

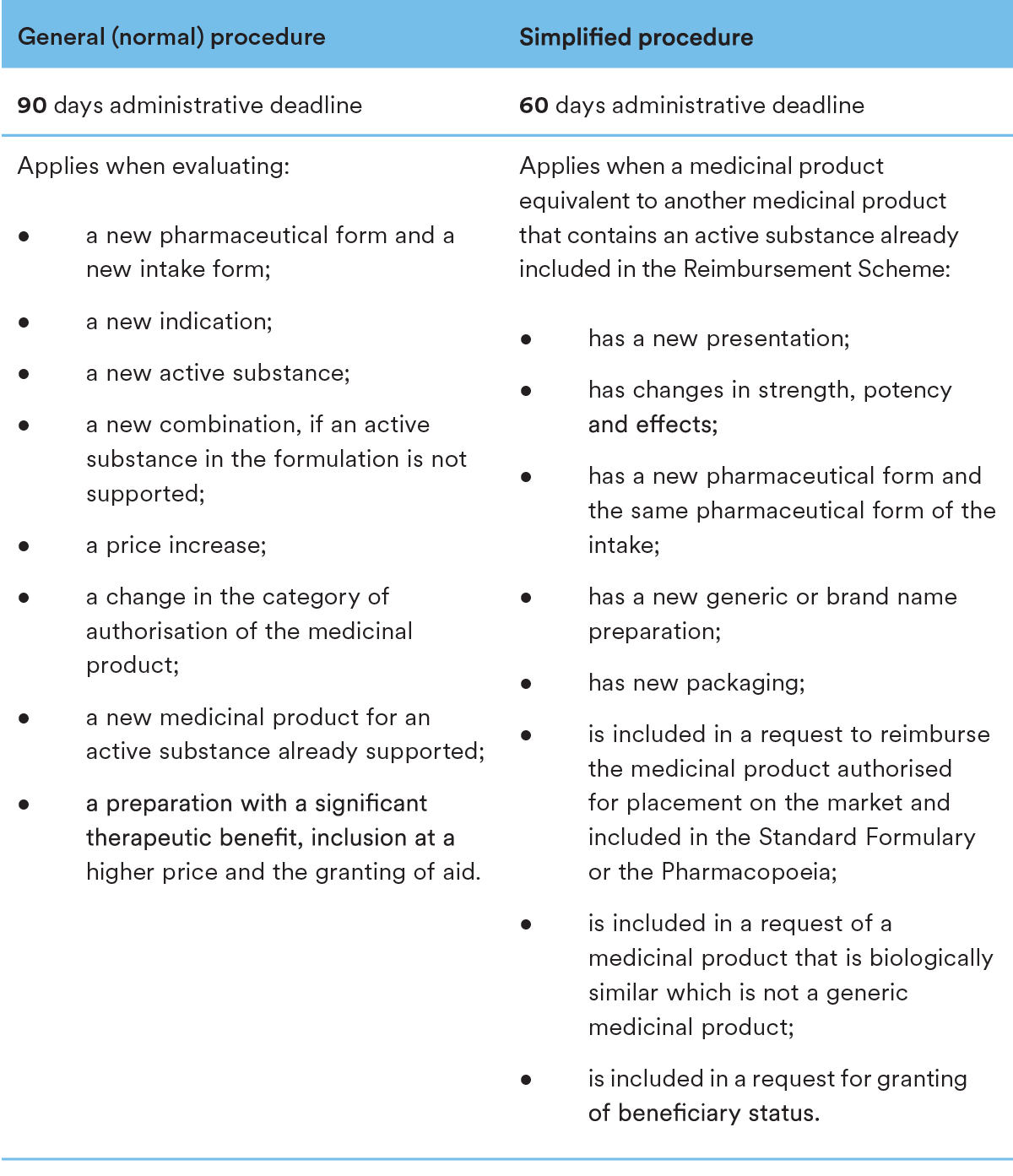

In case of procedures initiated by an applicant, once NEAK commences the proceedings based on a duly submitted Inclusion Request, NEAK may follow two different procedures in order to evaluate the application and render its decision on including the medicinal product in the Reimbursement Scheme. In case of a new pharmaceutical form, active ingredient, combination, etc., the normal procedure applies, while a simplified procedure may apply for an equivalent product containing an already supported active ingredient. As it is already mentioned above, NEAK initiates ex officio procedures. Such procedures are initiated for review purposes, summary follows:

A medicinal product is to be included in the social security funding if it fulfils the following criteria:

- the safety and efficacy of the product have been recognised by the competent authority and it has been authorised for marketing;

- the cost-effectiveness of the product is proven by the expert body of the National Institute of Pharmacy and Nutrition (“OGYÉI”);

- the product is economically and appropriately available for therapeutic use;

- the necessary financial resources are available and can be secured from the state budget of Hungary;

- the applicant undertakes to comply with the rules on insurance costs;

- MAH undertakes to distribute medicinal products with the reimbursement and to keep it in stock.

Medicinal products with the same active ingredient or therapeutic effect already included in the procedure will be given preference over medicinal products with a lower price (the simplified procedure applies to these medicinal products).

If the medicinal product meets the eligibility criteria to be included in the Reimbursement Scheme set out in Section 1.1. above, the method and amount of reimbursement will be determined according to the following health policy principles:

- Professional substantiation: decision-making based on scientific evidence, the application concerns only those MP’s that were professionally evaluated, registered and certified as safe and effective by bodies specifically authorised by law;

- Budgetary framework, eligibility for funding: decisions on the inclusion of medicinal products must consider the budgetary framework of the Hungarian Health Fund, as laid down in the Act on the Central State Budget of Hungary currently in force, and equally ensure that the budgetary impact of the inclusion of medicinal products is predictable and financeable on a long term basis;

- Transparency, verifiability: passing of these decisions must follow the procedures set out by law and shall not deviate from them. A clear separation and interconnection of the responsibilities of the participants involved in each decision-making phase must be ensured. There must be clarity in the interpretation of the information and data to be assessed and the predefined rules and criteria for decision-making; the basis for decision making must be presented, the basis and justification of the assessment and decision as well as its reasoning must be clearly presented;

- Predictability: the decision on the Inclusion Request and its review must have a clear timetable and the decisions regarding inclusion in the Reimbursement Scheme must clearly indicate the level of reimbursement and inclusion of the medicinal product;

- Publicity: the reasons for decisions and the information on which they are based are public and accessible; and the manner, content and timing of disclosure is determined by the law;

- Transparency of interests: transparency, disclosure, and presentation of the different interests of persons and institutions involved in decision-making and opinion-forming in relation to the subject matter of the decision;

- Needs-based approach: the nature of the health problem, the characteristics, number, distribution, and severity of the condition of the patient population must be considered and analysed in the assessment and decision-making process;

- Cost-effectiveness: the decisions on the inclusion should be made based on costeffectiveness; the definition of funding rules, units of funding and conditions should encourage cost-effective health care in practice.

The types of reimbursement granted for the relevant product can be received in the following forms:

- A percentage-based reimbursement on consumer price of the relevant medicinal product (100% / 90% / 80% / 70% / 55% / 50% / 25% / 0%);

- A fixed amount, provided based on the following:

- Active substance

The amount of reimbursement fixed for a product group with the same active substance is based on the price of a reference product accepted as the basis for public funding;

The price of the reference product accepted as the basis for public funding is the reference price for the group. The rate of subsidy for medicinal products with a daily therapeutic cost lower than the reference price is equal to the percentagebased reimbursement granted for the reference price. - Therapeutic fixed rate

The amount of reimbursement is calculated on the basis of the Days of Treatment (“DOT”) using a specific formula;

A reimbursement may be granted for a range of products equally suitable for the treatment of specific diseases (pathologies), if they have the same therapeutic purpose in a four-tier five-digit ATC group and have the same indication.

- Active substance

- given through a price-volume agreement (támogatásvolumen-szerződés) (“PVA”) (see Section 5 below);

- given through a contract for special subsidised medicinal products acquired through public procurement;

- limited to a fixed amount, reduced by a fixed amount or percentage;

- limited to a different percentage or a fixed amount depending on patient cooperation;

- determined based on a maximum fee as laid down in a regulation of the Minister responsible for health insurance.

2. Pricing rules

Establishing the price of the product remains at the discretion of the manufacturer/ distributor, based on economic and commercial considerations.

The NEAK has the right to decide whether an application will be accepted for reimbursement, but the rate of reimbursement is determined by applicable laws.

A medicinal product may receive social security reimbursement only if the manufacturing price of the medicinal product indicated in the application by the marketing authorisation holder is not higher than the lowest producer price of a medicinal product with the same or equivalent active ingredient currently marketed in the Member States of the European Union, and in other states party to the Agreement within the European Economic Area, and if the product is reimbursed in at least three of these states for the indication applied for.

In the case of medicinal products with the same active ingredient or therapeutic effect, the social security contribution (i.e. reimbursement) may be set at a maximum level equivalent to the contribution for the reference product.

For more details regarding the inclusion of medicinal products in the social security funding system, please refer to Section 1 above.

3. Key steps in the P&R procedure

4. P&R for specific categories of products

There is no specific legal framework for the reimbursement of orphan drugs. However, a medicinal product which cannot be listed in the green box of the Reimbursement Code (see below) due to health-economic reasons, may still be included in the yellow box if it shows substantial additional therapeutic value for patients.

Medicinal products which are not included in the Reimbursement Code may be reimbursed in justified exceptional cases if the treatment is necessary for compelling therapeutic reasons and cannot be carried out with medicinal products listed in the Reimbursement Code (also subject to approval from the Chief and Control Medical Service of the Insurance Carriers).

5. Managed Entry Agreement in the P&R process

Managed Entry Agreements („MEA”) are not mandatory in Austria. MEAs may include cost / risk sharing models that will help to manage the uncertainty around the financial impact or performance of a medicinal product. They are usually confidential and concluded between MAH and the social insurance carriers or operators of hospital pharmacies. The use of MEAs by social insurance carriers and publicly funded health institutions has been criticized in Austria due to the lack of transparency.

Related experts

POLAND

1. Overview of the P&R regulatory framework for medicinal products

The reimbursement regulatory framework is provided for in the Act of 12 May 2011 on the Reimbursement of Medicines, Foodstuffs Intended for Particular Nutritional Uses and Medical Devices (the “Reimbursement Act”), but a major amendment to the Reimbursement Act is currently underway. Although the expectations of the pharmaceutical industry were that the widely criticised draft would be rejected in its entirety, it seems that the legislative work will continue, and the draft amendment will make it to the Polish Parliament later this year (the “Draft Amendment”).

The pricing of medicinal products is not subject to any state regulation unless the products are reimbursed, in full or in part, by the public payer – the National Health Fund (the “NHF”). Reimbursement is granted by way of an administrative decision of the Ministry of Health (the “MoH”), based on a motion submitted by the marketing authorisation holder as an applicant (the “MAH”). The MoH is also authorised to issue a reimbursement decision ex officio, but this authorisation is rarely used. Following the reimbursement decision, the medicinal product is listed on the reimbursement list (the “Reimbursement List”) updated by the MoH every two months (however, this may be changed to three months, as per the Draft Amendment).

Medicinal products eligible for reimbursement

Medicinal products are reimbursed in Poland in three categories: (i) products dispensed in a pharmacy based on a prescription (this category guarantees the greatest access to patients), (ii) products administered during chemotherapy, and (iii) products used in a drug programme (which is limited to a given indication and has strict patient eligibility criteria). It is up to the MAH to decide which reimbursement category should be indicated for the product in the reimbursement application – although the MoH is authorised not to accept said choice.

Regardless of the above-mentioned categories, a product can be reimbursed only if: (i) it is approved for sale or remains on the market, (ii) it is available on the market (i.e., for patients in the retail market), and (iii) it has a GTIN (Global Trade Item Number) identification code or other unique code. The last condition is of great practical importance – only products with GTIN codes identical to the GTIN codes indicated in the reimbursement decision and the reimbursement list may be settled by the hospital or pharmacy with the NHF.

There are a number of exceptions which allow for reimbursement of the medicinal product despite not meeting the requirements listed above, such as medicinal products from direct import (products imported from abroad for a patient’s individual needs, which by definition are not available on the market) or ex officio off-label reimbursement (i.e., for indications that do not fall within the SmPC of a medicinal product, if it is required to save the patient’s life or health).

Medicinal products not eligible for reimbursement

Medicinal products outside the Reimbursement List are generally not subject to reimbursement with public funds. For instance, according to the Reimbursement Act, medicinal products which can be effectively replaced by a change in the patient’s lifestyle or have an OTC equivalent (unless they have to be administered for more than thirty days for a specific clinical condition), may not be included in the Reimbursement List. Certain medicinal products which do not qualify for the Reimbursement List may be financed from public funds via additional pathways: (i) emergency access to medicinal product technologies (RDTL), and (ii) medicinal products available through direct import for individual needs. These procedures are available to individuals for treatment with a nonreimbursable product that is either not available on the market and not authorised in Poland (direct import) or available on the market and authorised in Poland (RDTL).

2. Pricing rules

For the purpose of all patients having the same prices of reimbursed medicinal products, all prices and margins are fixed at all levels of distribution. A fixed price, inclusive of VAT for the first wholesaler (the “Official Selling Price”), is set in the reimbursement decision issued by the MoH following negotiations with the Economic Commission (please see further comments on the procedure in Section 3 below).

Several criteria must be considered for the purpose of setting the Official Selling Price which, among others, include: (i) the maximum and minimum net selling price obtained in Poland and in particular EU Member States; (ii) information on rebates, discounts or pricing agreements in other EU Member States; (iii) impact on the public budget and payment abilities of the public payer, (iv) the cost of treatment with other medicinal products having similar therapeutic properties (comparators) and (v) the threshold cost of gaining an additional quality-adjusted life year – QALY (currently at three times the GDP per capita), and the level of the applicant’s investment activity in the territory of Poland.

Reimbursed medicinal products have defined levels of co-payment and the reimbursement limit. The limit sets the amount up to which the public payer reimburses the product. The medicinal product whose price exceeds the limit will always require co-payment. The amount of the limit (the “Reimbursement Limit”) is calculated within so-called limit groups, into which medicinal products, both original and generic, are classified based on their indications (the “Limit Group”). The Reimbursement Limit is set at the cheapest product considering the level of its market share (general rule) or turnover (drug programmes and chemotherapy products). There are further specifications in pricing rules depending on whether the reimbursement is for outpatient or inpatient treatment.

For reimbursed outpatient products, there are two levels of distribution – wholesalers and pharmacies. The wholesalers’ mark-up is fixed at 5% and the pharmacy retail mark-up is calculated in accordance with a detailed formula indicated in the Reimbursement Act. The pharmacy margin is degressive, meaning that the margins are ordered from the highest to the lowest, in inverse proportion to the wholesale price (the Official Selling Price plus 5% margin) of the medicinal product. There are four levels of reimbursement of outpatient products: (i) free of charge, (ii) a lump sum payment, (iii) co-payment of 50% or (iv) copayment of 30%. These always apply to the price up to the Reimbursement Limit. If the price of the prescribed outpatient product is equal to or lower than the Reimbursement Limit, a patient will receive the product free of charge. If the price exceeds the Reimbursement Limit, the patient will pay the difference between the retail price and the Reimbursement Limit. The second level includes products dispensed for a lump sum payment up to the Reimbursement Limit. If the price of the product exceeds the Reimbursement Limit, the patient is obligated to cover the difference in addition to the lump sum. In the case of co-payment levels, the patient receives a medicinal product after paying 50% or 30% (as applicable) of the price. Again, if the price exceeds the Reimbursement Limit, the patient is obligated to cover the difference in addition to paying 50% or 30% of the price.

For reimbursed inpatient products sold to hospitals, the Official Selling Price changes into a maximum price. This means that hospitals are obligated to purchase medicinal products for a price that cannot exceed the Official Selling Price plus the official wholesale margin. In other words, if hospitals purchase medicinal products for a price “no higher than” the Official Selling Price and the wholesaler’s margin is not fixed. As a result, manufacturers of inpatient reimbursed medicinal products may sell the products below the Official Selling Price, and wholesalers may decrease their margin when offering such products to hospitals in public tenders. Inpatient products are fully covered by the NHF – the abovementioned patient’s co-payment rules for outpatient products do not apply.

Generics and biosimilars

The price of the first generic product and the first biosimilar product on the Reimbursement List cannot exceed 75% of the price of the original (reference) product. In Poland, there is no obligation to replace the original medicinal product with a generic product once available. Nevertheless, pharmacists are obligated to inform patients about a cheaper alternative to the prescribed original product. It is also common practice for the NHF to make non-binding attempts to encourage hospitals to substitute the original products with generics and free up financial resources to be used for other purposes.

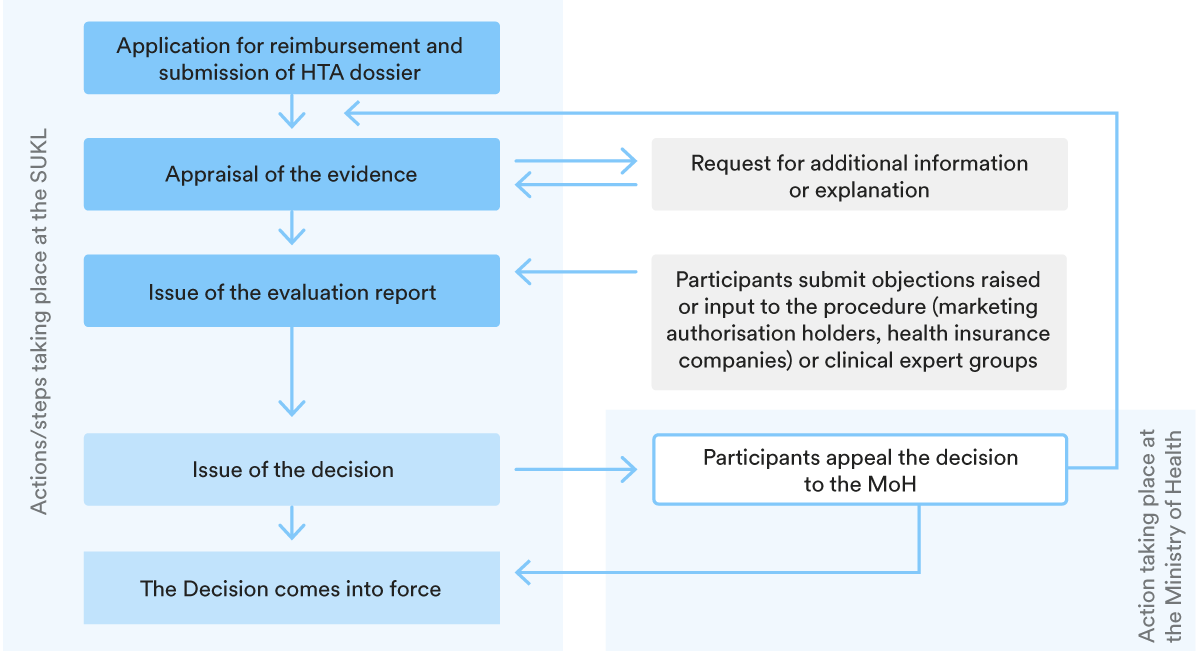

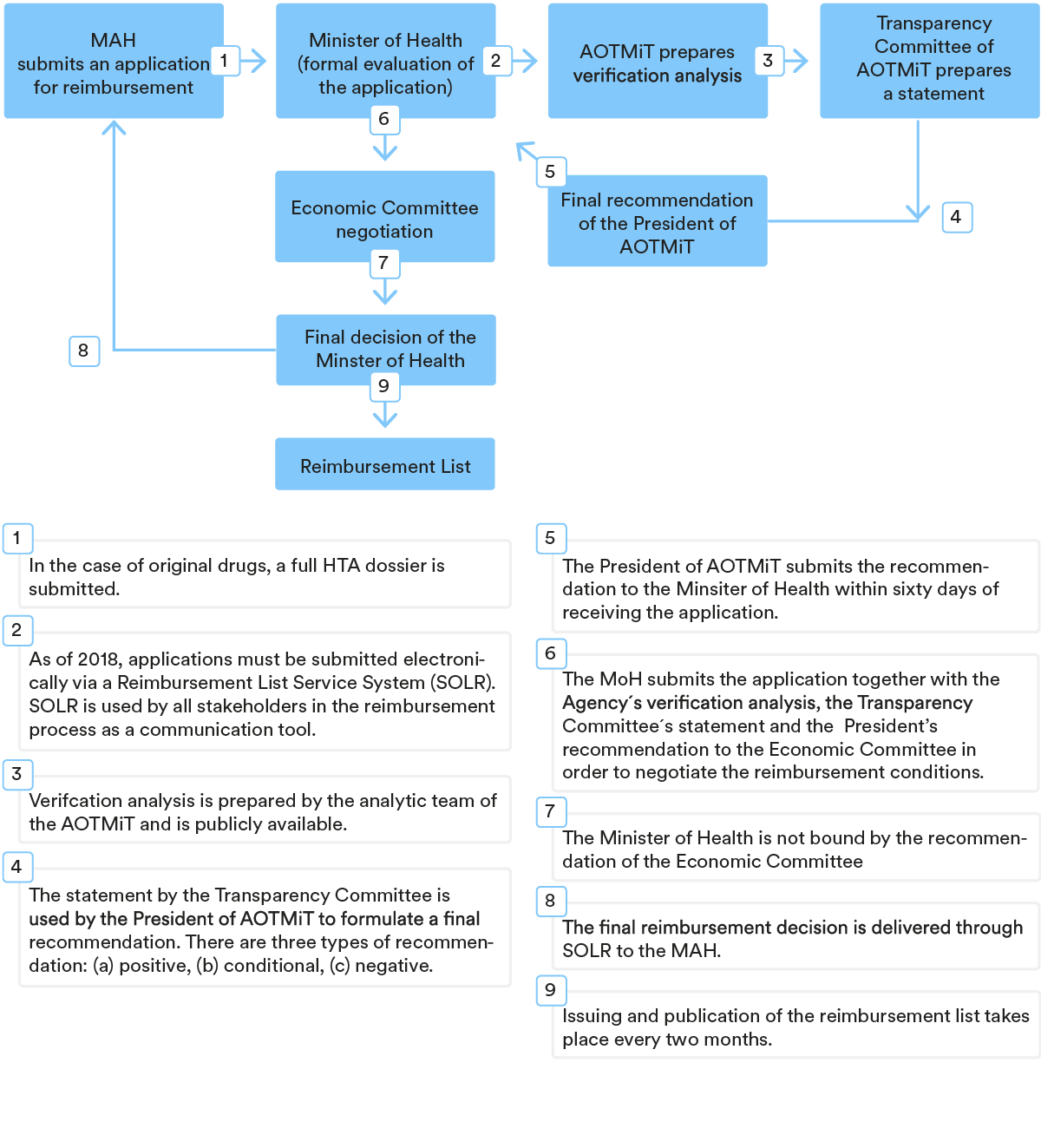

3. Key steps in the P&R procedure

The procedure for including a medicinal product in the Reimbursement List is usually initiated by the MAH by filing an application for a formal review to the MoH. The application for reimbursement must be supplemented with detailed information and several attachments, including the number and level of granularity, which depends on the type of medicinal product (original, generic, biosimilar). For example, for original products, MAH must provide a full HTA dossier with a clinical, economic and budget impact analysis, whereas generics require only a budget impact analysis.

Once the MoH has formally evaluated the application, it provides the HTA dossier to the Polish Health Technology Assessment Agency (the “AOTMiT”) for the purpose of assessment in a so-called verification analysis. It is a publicly available document (although sensitive business information is redacted) which contains, among other things, a recommendation on whether the reimbursement should be granted or not, and an assessment of the MAH’s pricing proposal. It is possible to submit comments on the analysis within seven days of its publishing.

Based on the verification analysis, as well as on the statement from the Transparency Council (the opinion-giving advisor of the President of AOTMiT), the President of AOTMiT issues a recommendation on whether a medicinal product should be financed using public funds, along with terms and conditions for said reimbursement.

Subsequently, the MoH submits the application together with the Agency’s verification analysis, the Transparency Council’s stance and the Agency President’s recommendation to the Economic Commission in order to negotiate the reimbursement conditions. Negotiations with the Economic Commission, a body of experts supporting the MoH, are widely reported as challenging due to the imposed pressure to lower prices or set better conditions in risk-sharing agreements.

The reimbursement application must be examined within 180 days (unless the application needs to be supplemented, in which case the clock stop applies). In practice, the reimbursement procedure in Poland is one of the longest in EU countries and rarely lasts less than two years. Reimbursement decisions are issued for a period of either two or three years, with the first decision always granted for two years only.

Stages of reimbursement decision-making (standard path)

4. P&R for specific categories of products

As part of a policy to increase the limited access to innovative drugs in Poland, the so-called Medical Fund was established in 2020 and new reimbursement fast tracks were introduced for highly innovative products (the “HI products”) or products with high clinical value (the “HCV products”). One of the main goals of introducing the Medical Fund was to support access to the latest therapies, especially with regard to rare and oncological diseases. At first, separate funding sources were envisaged for the Medical Fund. Currently, however, the funding for the Medical Fund comes from the total NHF reimbursement budget.

In both fast tracks, the AOTMiT conducts evaluation and selection of HI and HCV products for the purpose of creating a list of products with a positive assessment. Such a list has been prepared on a one-off basis only for HCV products, while for HI drugs it is published periodically (at least once a year).

The most significant specifications for the HI product reimbursement process include the following: (i) the MAH is not obligated to submit a full HTA dossier, only a payer budget impact analysis, (ii) the duration of the reimbursement procedure for HI products has been shortened to 60 days, (iii) a time frame for negotiation with the Economic Commission has been set at up to 30 days, whereas a standard reimbursement path has no time limit for negotiation, (iv) the usually burdensome requirement of proof of availability on the market can be replaced for HI products with a commitment to ensure technological readiness for its production, (v) MAH may submit the application only after the product is published on the list of HI products and (vi) the outcome of price negotiations with the Economic Commission is publicly available (with sensitive commercial information redacted).

The Medical Fund-financed reimbursement that received the most media attention concerned the product Zolgensma, a genetic therapy used to treat spinal muscular atrophy (SMA), which often affects very young children. However, access to treatment with Zolgensma, dubbed “the most expensive drug in the world”, is still limited in Poland, as criteria for inclusion in the drug programme are very restrictive.

5. Managed Entry Agreement in the P&R process

The concept of Managed Entry Agreements does not exist in Poland, but a similar concept, known as risk-sharing schemes (the “RSSs”), has been introduced. For the purpose of reconciling the patient’s needs with the NHF’s financial capacity, the Reimbursement Act introduced an open catalogue of solutions which may be introduced as RSSs. The RSSs should be provided by the MAH in the reimbursement application, although so far, it has also been possible to submit them during negotiations with the Economic Commission.

The RSSs are usually provided by MAH, because a voluntary RSS exempts MAH from participation in a statutory payback mechanism. The statutory payback is triggered if reimbursement expenses of the NHF exceed the fixed annual budget for reimbursement, which is currently set at 17% of the amount allocated in the NHF’s annual financial plan for the financing of guaranteed healthcare services. So far, the statutory payback has not been used. However, this is likely to change with the introduction of the Draft Amendment, which narrows the abovementioned exception. As the Draft Amendment currently reads, the exemption would apply if the actual value of RSSs (e.g. benefits obtained by, or receivables to be paid to, NHF) is equal to or higher than the calculated statutory payback. Otherwise, the MAH is obligated to cover the difference subject to some further rules.

The most popular RSSs involve price-volume schemes and confidential discounts to hospitals, whereas the outcome-based RSSs are almost non-existent. This is set to change with the introduction of the Medical Fund, which has introduced the obligation to collect data that may form the basis of risk-sharing agreements once HI products are reimbursed. Thus far, clinical data have been collected and analysed only for the products available in drug programmes. The agreed RSS is included in the reimbursement decision and remains confidential – access to information on the content of the scheme is restricted to the MoH and NHF (and, to the extent that a discount-based RSS simultaneously becomes a maximum price, to hospitals).

Related experts

ROMANIA

1. Overview of the P&R regulatory framework for medicinal products

In Romania, patients insured within the national health insurance system can receive medicinal products either free of charge or by making a co-payment when such products are included on the list of international non-proprietary names (“INNs”) reimbursed in Romania (“Reimbursement List”).

The Reimbursement List is divided in 4 (four) distinct sub-lists with different levels of reimbursement granted for medicinal products:

- Sub-list A within the Reimbursement List includes the INNs corresponding to medicines available to insured persons in outpatient treatment under the compensation scheme of 90% of the reference price;

- Sub-list B within the Reimbursement List includes the INNs corresponding to medicines available to insured persons in outpatient treatment under the compensation scheme of 50% of the reference price;

- Sub-list C within the Reimbursement List includes the INNs corresponding to medicines for which the insured are 100% compensated, and is further divided into three parts:

- Part C1 refers to INNs corresponding to medicines available to insured persons for the outpatient treatment of certain groups of diseases (e.g. chronic diseases such as chronic heart failure, chronic hepatitis, etc.);

- Part C2 refers to INNs corresponding to the medicines benefiting insured persons included in national health programmes for curative purposes in outpatient and inpatient treatment;

- The list of the INNs included in sub-list C2, which are granted within the framework of national health programmes, and their reimbursement price, are approved by order of the Minister of Health and the President of the National Health Insurance House (“NHIH”);

- Part C3 corresponding to medicines for children up to the age of 18, young people from 18 to 26 if they are pupils, apprentices or students, if they do not earn an income, and pregnant women and women who recently gave birth, in outpatient treatment.

- Sub-list D within the Reimbursement List includes the INNs corresponding to medicines available to insured persons in outpatient treatment under the compensation scheme of 20% of the reference price.

Adding a medicinal product to the Reimbursement List implies the main steps below:

- Obtaining a marketing authorisation;a

- Confirming national pricing approval from the Health Ministry;

- Filing the request for HTA with the National Agency for Medicines and Medical Devices of Romania (“NAMMDR”) to establish if the INN may be included in the Reimbursement List;

- Negotiations with the NHIH (if applicable);

- Publication of the government decision to include the INN on the Reimbursement List.

Conditional reimbursement

For those medicinal products which were conditionally included in the Reimbursement List, the MAH concludes managed entry agreements with the NHIH and undertakes to support the treatment by paying a quarterly fixed percentage contribution, as described in Section 5 below.

2. Pricing rules

In Romania, the process of setting the list price of a medicinal product represents a separate and self-standing procedure, and shall occur before obtaining reimbursement via HTA.

The national catalogue of prices in Romania (“CANAMED”) is updated with the maximal manufacturer price expressed in the national currency of Romania (“Ron”) and proposed by MAH, when such proposed price is lower or at most equal to the lowest price of the same medicinal product in the source-catalogues of 12 European countries respectively: Austria, Belgium, Bulgaria, Czech Republic, Germany, Greece, Hungary, Italy, Lithuania, Poland, Slovakia, and Spain. The conversion into Romanian currency is set at exchange rates imposed by the Ministry of Health (triggering thus even more price pressure downwards). An annual price referencing is in place and generally happens every year, realigning the list prices downwards.

However, the price proposed by the MAH for the following medicinal products should be lower than or (at most) equal to the average of the lowest three (3) prices of the same product in the 12 comparison countries:

- immunologic medicines;

- medicines derived from blood or human plasma;

- essential medicines (i.e. generic, biosimilar and innovative medicines which have lost their patent and which cumulatively fulfil the following conditions: (i) their INN is included in the most recent list of essential medicines recommended by the WHO; (ii) their INN name is included in sub-list C within the Reimbursement List);

- medicinal products authorised on public health grounds by NAMMDR in the absence of a marketing authorisation or an authorisation application submitted for a medicinal product authorised in another EU Member State.

If a medicinal product listed above has a price approved in only one of the 12 comparison countries, the price proposed for Romania should be lower than or (at most) equal to the price in the respective country. If there is no price approved in any of the 12 comparison countries, the price for Romania could be approved at the level proposed by the MAH.

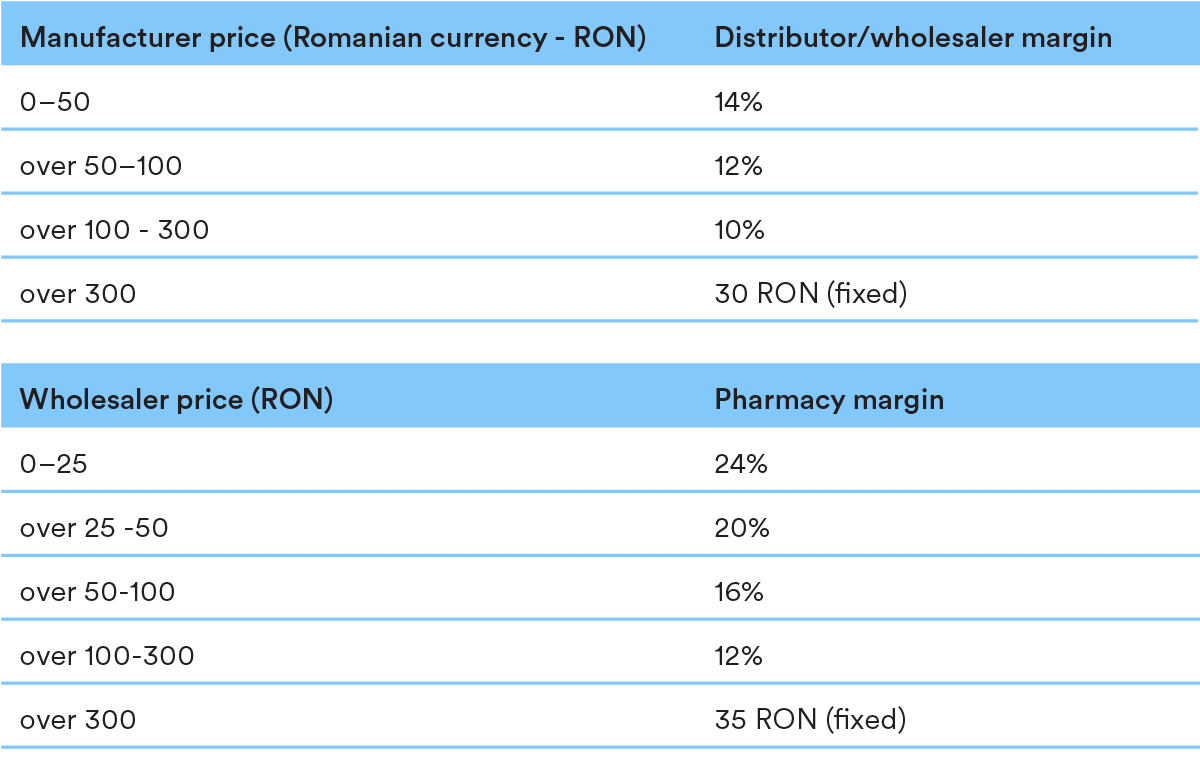

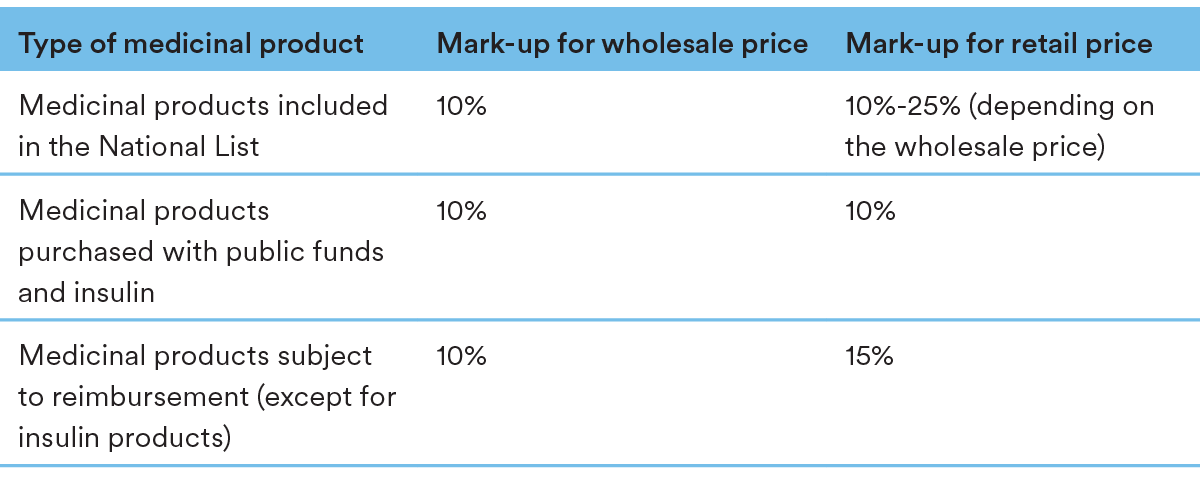

The pricing structure contains the following mark-up levels throughout the chain:

Generics and biosimilars

In case a listed price has already been approved for an innovative medicinal product with the same INN, pharmaceutical form and concentration as the generic product, the generic reference price to be approved shall be 65% of the manufacturer’s price of the innovative medicinal product. The same rationale is applicable for biosimilar products, whose reference price shall be 80% of the manufacturer’s price of its reference biological medicinal product. Thus, the prices of generic and biosimilar medicinal products shall be lower than or (at most) equal to the fixed reference prices calculated according to the indications above.

If the reference innovative/biological medicinal product has no approved price, the generic / biosimilar reference price shall be set according to the applicable general rules, as detailed in the first part of Section 2 above.

3. Key steps in the P&R procedure

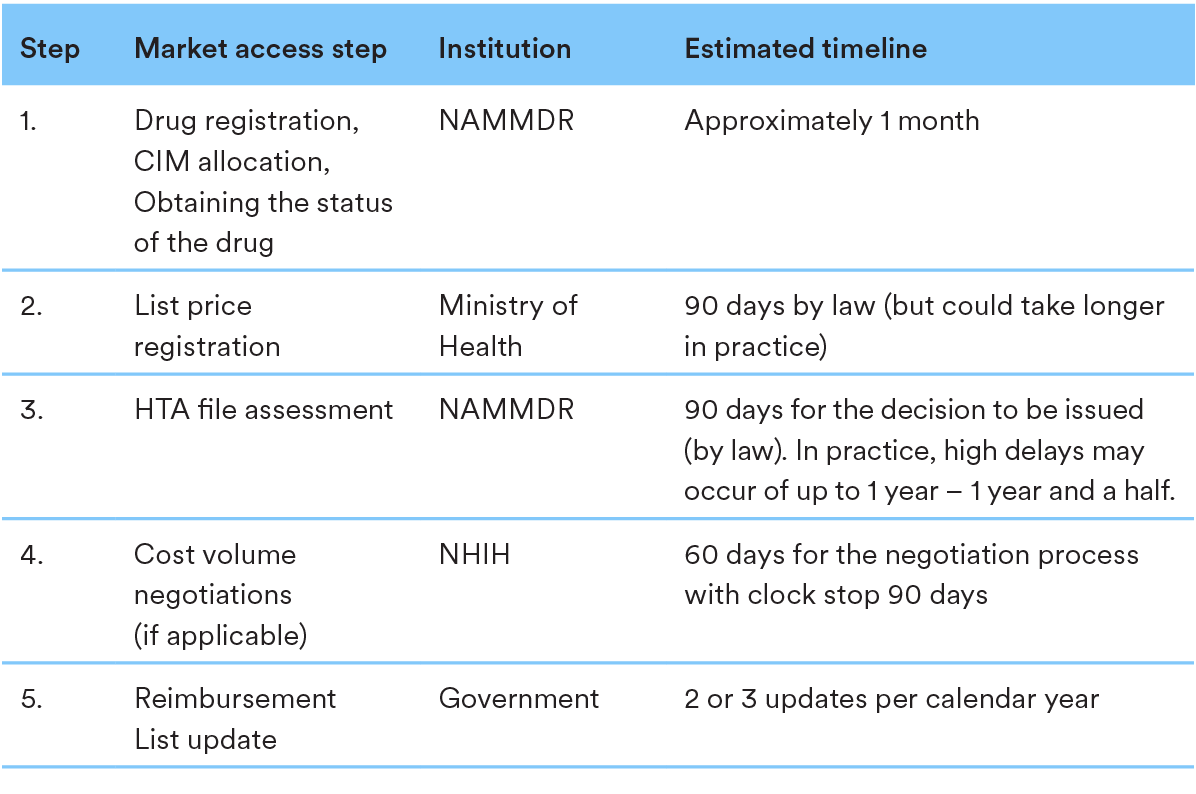

Please find below a chart illustrating the key steps required within the P&R process in Romania, identifying decision-making bodies, and average timing for final decisions:

4. P&R for specific categories of products

The P&R process for orphan medicinal products and Advanced Therapy Medicinal Products (ATMPs) are in line with the proceedings applicable to medicinal products in general, as detailed above.

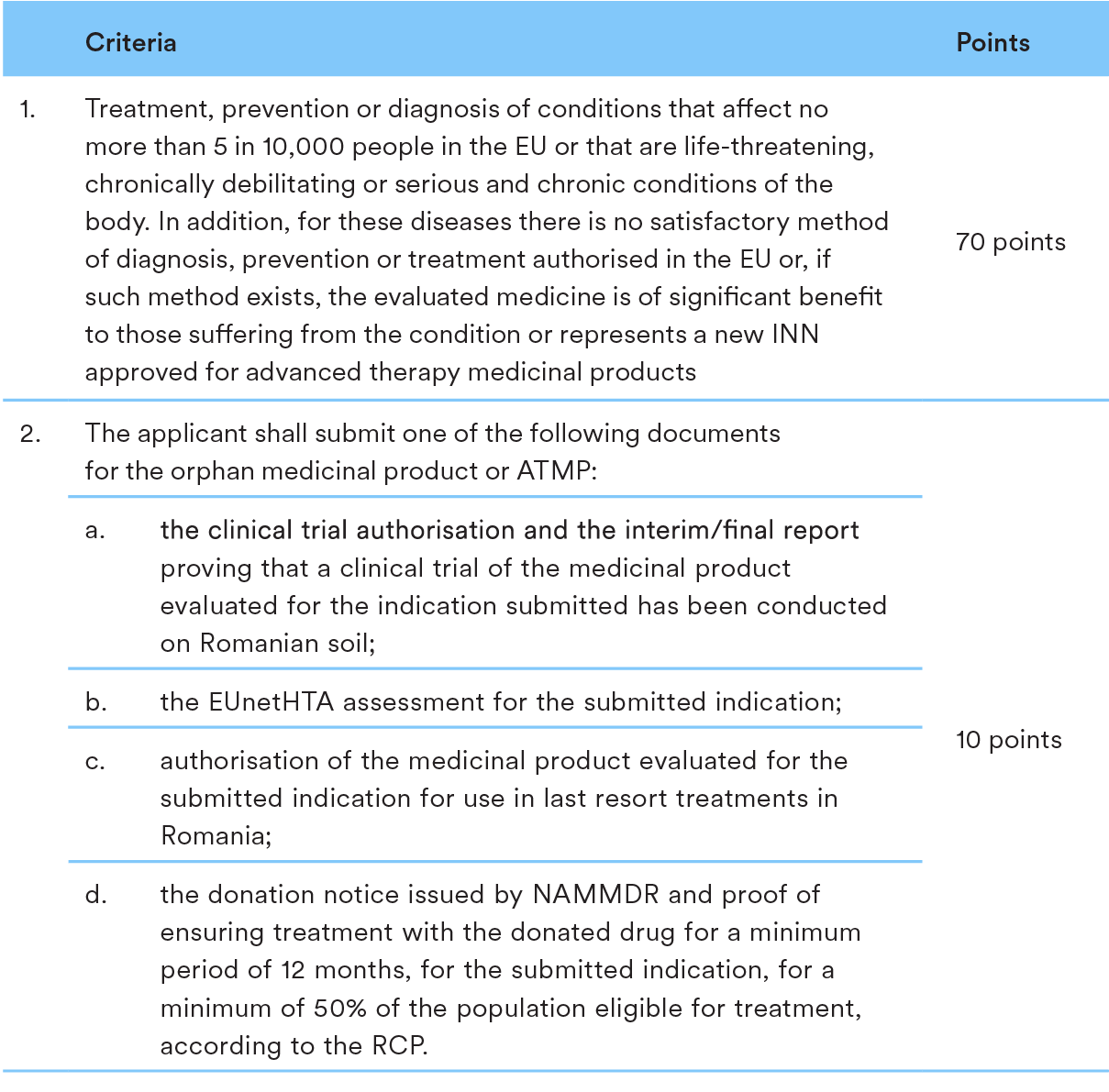

However, the HTA legislation stipulates special evaluation criteria applicable to orphan medicinal and ATMPs. In order to be included in the Reimbursement List, orphan medicinal and ATMPs shall meet the following criteria:

5. Managed Entry Agreement in the P&R process

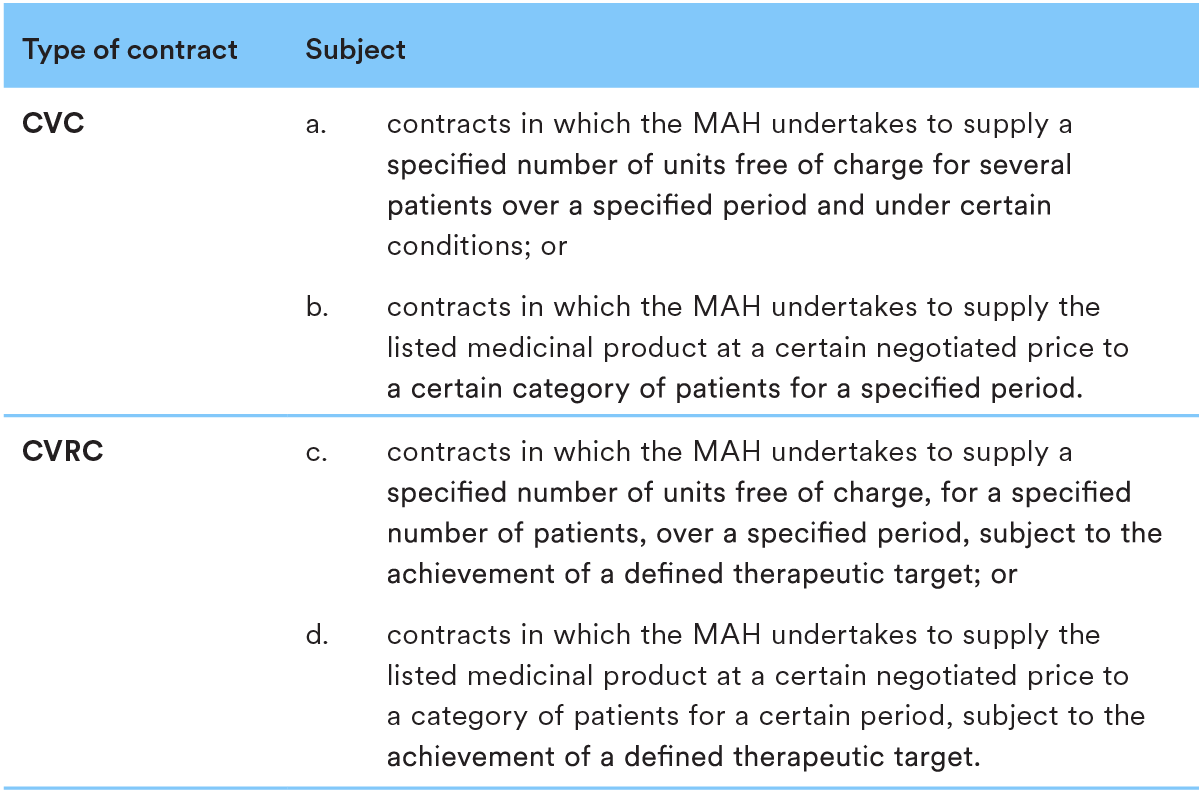

In Romania the Managed Entry Agreements are performed as cost-volume contracts (“CVC”) or cost-volume-result contracts (“CVRC”).

Please see below relevant descriptions for both CVC and CVRC:

CVC and CVRC are agreements concluded following a negotiation process between the NHIH and MAHs for medicinal products, facilitating patients’ access to medicines that are usually innovative and generally high-priced, based on the decision by NAMMDR regarding the conditional inclusion of such medicinal products in the Reimbursement List.

Based on the CVC or CVRC concluded, MAH undertakes to support the treatment with the medicinal product which was conditionally included in the Reimbursement List by paying a quarterly fixed percentage contribution, ranging from 25/30% to 70/75%, for a specific category of patients and for an indicated period.

As of 6 February 2023, the amount granted by the state budget remaining available for

the negotiation/resumption of the negotiation process for CVC and CVRC in 2023 is

approximately EUR 830 million.

Related experts

SLOVAK REPUBLIC

1. Overview of the P&R regulatory framework for medicinal products

Medicinal products are reimbursed from public health insurance if: (i) the product (and its respective indication) is placed on the Reimbursement List and (ii) a reimbursement exception is approved by a health insurance company.

Reimbursement List

Medicinal products can enter the Reimbursement List through a price and reimbursement procedure at the Ministry of Health. Only Rx Products can be placed on the Reimbursement List.

Reimbursement criteria include:

- cost effectiveness;

- budget impact;

- medical benefit and efficacy.

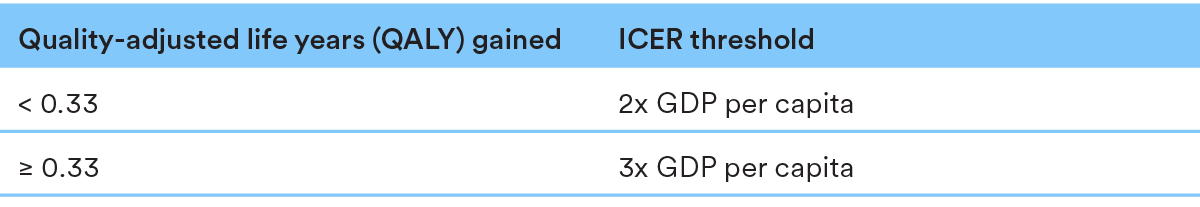

Medicinal products can be included in the Reimbursement List only if they pass the costeffectiveness test based on ICER thresholds.

Reimbursement exceptions

Medicinal products or their indications that are not on the Reimbursement List, off-label use and use of non-registered products can be reimbursed through exceptions, which are approved on an individual basis by health insurance companies.

The overall value of products that can be approved through exceptions per year is limited by law (in 2023: 3.9% of the total budget for medicinal products).

2. Pricing rules

International reference pricing

The list price of medicinal products cannot exceed the average of the three lowest prices in all other EU Member States.

Following placement of the product on the Reimbursement List, external reference pricing occurs:

- twice per year during the first 36 months from the date of placement on the Reimbursement List; or subsequently

- once per year.

Generics and biosimilars

The price of the first generic product and first biosimilar product on the Reimbursement List cannot exceed 51% and 75% of the original product respectively.

3. Key steps in the P&R procedure

4. P&R for specific categories of products

Medicinal products with EMA orphan status and Advanced Therapy Medicinal Products (ATMPs) enjoy special status in the P&R process.

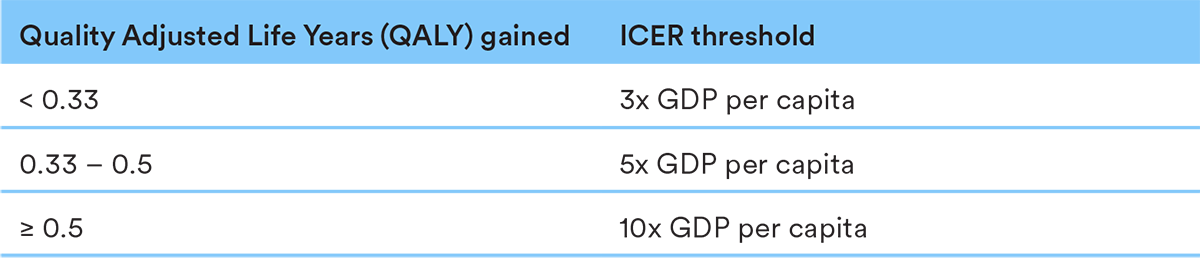

EMA orphan products and ATMPs have higher ICER thresholds than other products:

EMA orphan products and ATMPs can enter the Reimbursement List even without passing the cost effectiveness test at the discretion of the Ministry of Health, if the following is met:

- the MAH concludes a Managed Entry Agreement with the Ministry of Health;

- no alternative intervention is placed on the Reimbursement List,

OR

the product has significant added medical benefits when compared to alternative interventions on the Reimbursement List; - the financial stability of the system is maintained, and spending of public sources is purposeful and effective.

5. Managed Entry Agreement in the P&R process

A Managed Entry Agreement (“MEA”) concluded with the Ministry of Health is mandatory in a P&R process for:

- products with an annual budget impact ≥ EUR 1.5 Million;

- EMA orphan products;

- Advanced Therapy Medicinal Products (ATMPs);

- products with significant added medical benefits.

An MEA may be also optionally concluded in the P&R process to pass the cost effectiveness test or to obtain reimbursement for additional indications of a product already on the Reimbursement List.

Cost / risk sharing models

Each MEA must contain an expenditure cap with a payback obligation if the cap is exceeded. An MEA may also include other cost / risk sharing models, for example flat discount, portfolio deal and so on. Due to the mandatory expenditure cap, performance based MEAs are highly uncommon.

Related experts

UKRAINE

1. Overview of the P&R regulatory framework for medicinal products

Affordable Medicines Programme

On 1 April 2017 the Affordable Medicines Programme (“AMP”) came into force in Ukraine. The programme provides for state reimbursement of prescription medicinal products for cardiovascular diseases, bronchial asthma, diabetes, epilepsy, Parkinson’s and other relevant diseases in the outpatient sector. Medicinal products eligible for reimbursement under the AMP are included in the register of medicinal products subject to reimbursement under the programme of state guarantees of medical care (“Reimbursement Register”). Only medicinal products included in the list of international non-proprietary names (INN) of medicinal products can be included in the relevant registry.

Other grounds for reimbursement/purchase of medical products with public funds

Apart from AMP, patients in the outpatient sector who are included into the reimbursement population categories (e.g. war veterans) or have a specific disease (e.g. cancer or HIVinfection) are entitled to obtain medicinal products for free or with partial reimbursement from public funds based on the relevant order of the Cabinet of Ministers of Ukraine (“CMU”) dating back to 1998.

Moreover, medicinal products in the outpatient sector can be reimbursed by private insurance companies based on the relevant voluntary health insurance agreements.

In addition to the AMP, medicinal products included in various lists (e.g. the National List of Essential Medicines (the “National List”)) are purchased with public funds based on different schemes, including the following:

- medicinal products included in the National List are purchased by healthcare institutions that are fully or partially financed by the state and local budgets;

- certain medicinal products are purchased by the Ministry of Health (“MoH”) / State Enterprise “Medical Procurement of Ukraine” (“SE”) on the basis of agreements with specialised procurement organisations (e.g. Crown Agents Limited);

- original (innovative) medicinal products can be purchased with state budget funds based on the Managed Entry Agreements (“MEAs”) between MAHs and the MoH or SE.

2. Pricing rules

General requirements

The following mark-ups are established for medical products sold on the Ukrainian market:

The following mark-ups are established for medical products sold on the Ukrainian market:

- narcotic, psychotropic medicinal products, precursors and medical gases; and

- medicinal products procured in accordance with the MEAs.

International reference pricing

Due to the increase of prices of medicinal products in Ukraine during the war, on 5 October 2022 the MoH approved an order under which marginal wholesale prices for certain medicinal products should be defined based on the prices for the same medicinal products in a group of reference states (Poland, Slovak Republic, Czech Republic, Latvia and Hungary). Such a requirement applies to:

- medicinal products included in the National List; and

- medicinal products that are recommended for inclusion into the lists of products to be purchased with state budget funds (except for those for which conclusion or prolongation of the MEAs is recommended).

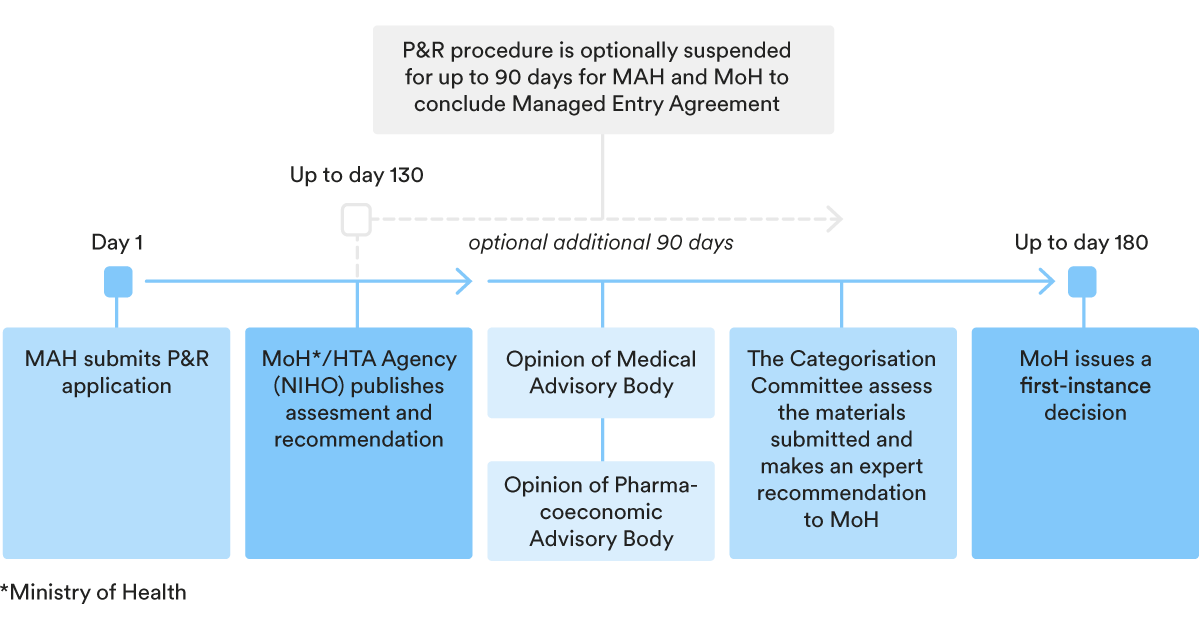

3. Key steps in the P&R procedure

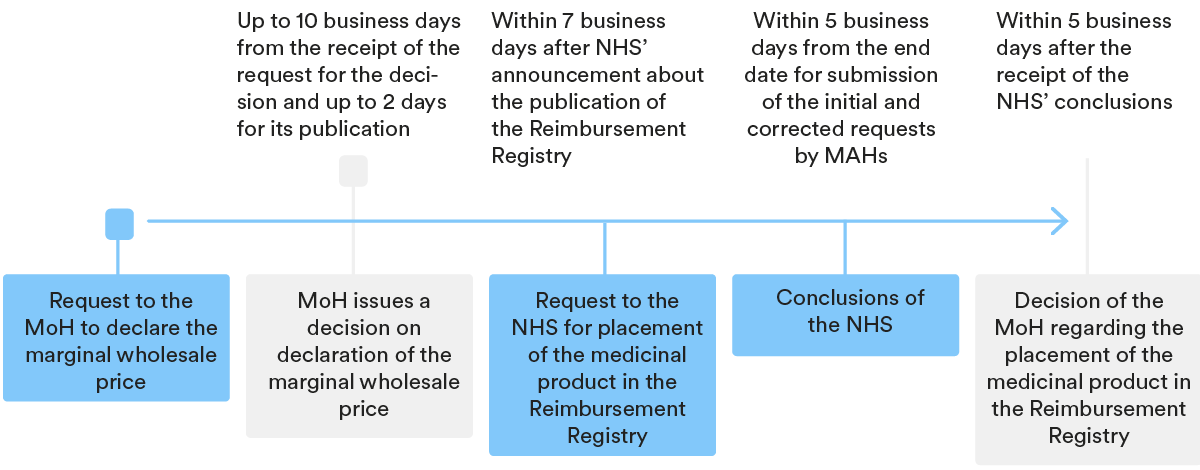

In order for a medicinal product to be included in the Reimbursement Register, the marketing authorisation holder (“MAH”) should follow the relevant price and reimbursement (P&R) procedure, which generally speaking consists of two parts:

- a declaration of a marginal wholesale price; and

- the inclusion of the medicinal product in the Reimbursement Register.

Declaration of marginal wholesale price

Periodically, the MoH publishes on its website the Register of marginal wholesale prices for medicinal products subject to reimbursement (“MWP Registry”). Based on information from the MWP Registry, the MAH should calculate the marginal wholesale price of its medicinal product and declare it with the MoH.

After the marginal wholesale price of the medicinal product is declared with the MoH, the authority provides the relevant price to the Register of Wholesale Prices for Medicinal Products and the MAH can apply for an inclusion of the relevant product into the Reimbursement Register.